ECB cuts interest rates to 2.75% as central banks diverge

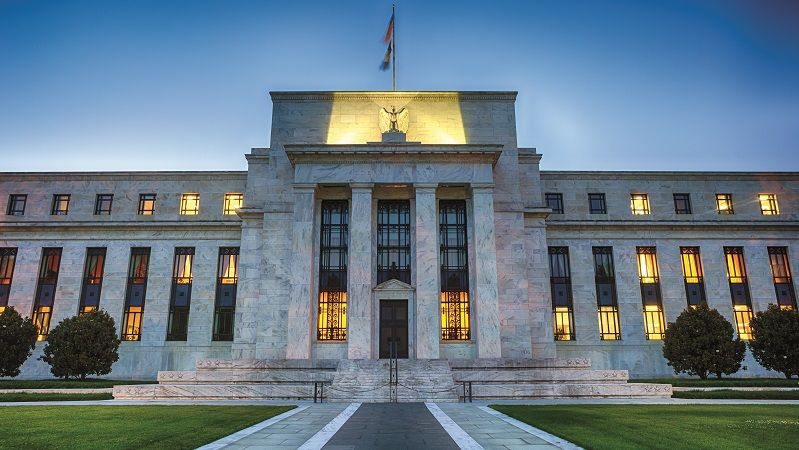

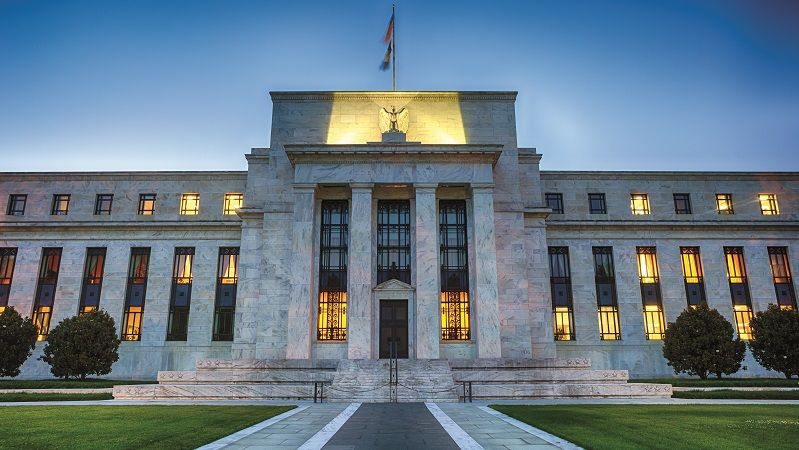

Follows the Federal Reserve’s decision to hold the Fed Funds rate at 4.25-4.5%

Follows the Federal Reserve’s decision to hold the Fed Funds rate at 4.25-4.5%

European consumers now have ‘room to go out and spend’

Hannah Williford canvasses market-watchers on the Fed’s decision to maintain current rates

The path towards a target of 2% is proving more turbulent than many investors had expected

Democrats and Republicans may have reached agreement on a spending deal but ‘unsustainable’ levels of debt continue to be a cause for concern With another funding deadline looming, the Democrats and Republicans have reached a $1.66trn deal on US spending. This averts another potentially disruptive shut-down. Nevertheless, the level of US government debt remains a…

The pace of US consumer spending looks set to slow down over the medium-to-long term, writes Cherry Reynard The US economy turned in an astonishing performance for the third quarter, growing at an annualised rate of 4.9% between July and September. Financial markets aren’t sure whether to be happy or alarmed at the pace of…

The Federal Reserve held the US base rate steady again last night at a 22-year peak of 5.25–5.5%, as widely expected, writes Alex Sebastian. While the decision to leave rates unchanged was no surprise, Chair Jerome Powell’s accompanying commentary was where the interesting elements were found. While once again reiterating the Fed’s determination to bring…

Have inflationary pressures eased sufficiently for central banks to start cutting interest rates? Cherry Reynard takes a closer look In recent days, both the US Federal Reserve and – more surprisingly – the Bank of England have chosen to leave interest rates on hold. While both central banks have issued stern words about the need for caution and said…

Investors have been left with a difficult judgement to make on the near-term direction of markets after the Federal Reserve held US rates flat at 5 – 5.25% last night. The most notable aspect of the Fed meeting was not the holding of rates, which was widely expected, but the hawkish commentary that accompanied it.…

‘We tend to use it to mean that it won’t leave a permanent mark’

As Bank of England also votes to maintain at 0.1%

The outlook for high yield in 2021