The pace of US consumer spending looks set to slow down over the medium-to-long term, writes Cherry Reynard

The US economy turned in an astonishing performance for the third quarter, growing at an annualised rate of 4.9% between July and September. Financial markets aren’t sure whether to be happy or alarmed at the pace of growth, which was much faster than the 4.2% expected by economists.

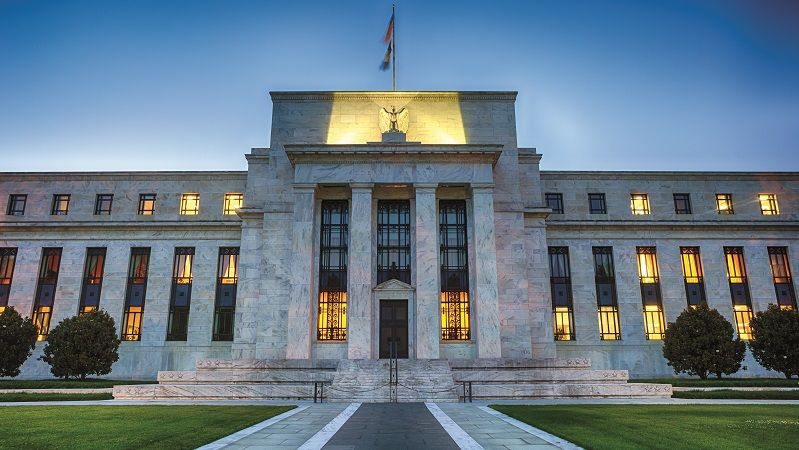

The fear is that this rapid rate of expansion, the quickest in nearly two years, will have an inflationary sting in its tail. This could push the Federal Reserve to raise rates again. As Fed chair Jerome Powell said at the time: “Additional evidence of persistently above-trend growth, or that tightness in the labour market is no longer easing, could put further progress on inflation at risk and could warrant further tightening of monetary policy”.

Therefore, the question of whether this was a one-off, or heralds a stronger rebound in the US economy is an important one. The Bureau of Economic Analysis attributed the strength in the US economy to a number of factors: an acceleration in consumer spending, private inventory investment, and federal government spending, plus an upturn in exports and residential fixed investment. In particular, the surge in consumption was noteworthy, with a 4% rise.

See also: Fed holds fire again as Powell strikes more dovish tone

There are reasons to believe that consumer spending cannot be sustained at its current pace. The pause in student debt repayments came to an end in October, a condition of the debt ceiling negotiations. This has far-reaching implications – around 12% of the US population has student loans. These 43 million Americans hold a collective $1.7trn in debt. Resuming repayments will weigh on household finances.

Equally, US consumers are further through their pandemic savings than many other countries. Fran Radano, manager of the Abrdn North American Income trust, says: “Consumers have had a lot of free money and that is still driving the economy. However, most of that is already spent, particularly among the lower quintiles of wealth.” Radano believes that if the jobs market starts to falter, consumers now have nothing to protect them from the impact.

Higher oil price

Rising energy costs may be another factor weighing on growth. The oil price has jumped from $69 a barrel in mid-June to a peak of $92 in September, and is now hovering around $83 a barrel. There are fears that this will spike higher as tensions rise in the Middle East. While the relationship between consumption and oil prices is imperfect, it could dent spending.

A combination of these two factors has helped cushion households from the worst impact of rate rises, but this cannot last indefinitely. Powell admitted in a recent speech that “given the fast pace of the tightening, there may still be meaningful tightening in the pipeline” – ie there may be no need to raise rates further. Equally, the recent rise in bond yields has seen the US 10-year treasury tip over 5%. This may also give central banks pause for thought.

See also: The trials and tribulations of investing in European equities

This is likely to slow the economy even without other factors. BlackRock’s Investment Institute goes even further, suggesting the US has been experiencing a ‘stealth stagnation’ over the past 18 months. It points to the disparity between two key measures: GDP and gross domestic income: “Gross domestic income, which adds up incomes and profits of households and firms – has been the weakest stretch ever seen outside a recession. We think this has gone under the radar because consumer spending, job growth and GDP have held up. We see stagnation persisting as the Federal Reserve keeps policy rates high in its battle with inflation.”

It points to research from the Bureau of Economic Analysis that suggests the average of GDP and GDI is the most reliable guide to what’s really going on in the US economy. BlackRock also points out that companies have not yet replaced all the jobs lost during the pandemic. It adds: “Recent job numbers are far from a sign of economic strength.” It also looks at US corporate profits, which – away from the distracting influence of big tech – are starting to plateau.

Stockmarket implications

There is a question over what this means for US stockmarkets. There are worries over over-valuation, but this is mostly confined to the ‘Magnificent Seven’. While they form a significant part of the overall earnings for the US stockmarket, their fortunes have relatively little to do with the US economy. The recent round of earnings from big tech has been generally encouraging, but share prices have been weaker, suggesting expectations had over-reached.

See also: Central bank divergence: Have the gains been made in Latin America?

Steven Bell, chief economist, EMEA at Columbia Threadneedle, is more optimistic: “The service sector has been strong, but it’s slowing. Manufacturing, which has been struggling through an inventory correction is beginning to pick up. That’s important for equities, which are much more sensitive to manufacturing than services.” Nevertheless, the 5% bond yield will create competition for capital and could exert a drag on stockmarkets.

Most commentators believe that there are still pockets of value in US markets, even if GDP growth weakens from here. Fraser Thomson, client services director on the Baillie Gifford American fund, says they are targeting major shifts in the US economy, such as the shift from television to streaming, or the broadening deployment of technology. They are also invested in the winners of sectors that are starting to consolidate, such as online delivery, where Doordash is starting to pick up market share.

For Radano, the opportunities are to be found in some of the more value and defensive areas of the market. He retains an overweight position in banks, for example, and healthcare, but also some of the consumer names where he sees a change in fortunes ahead.

Markets are right to be confused on the buoyant GDP figures. They probably won’t trigger more rate rises, but they make it more difficult to cut rates. Equally, they are unlikely to have a significant impact either way for US equities. It remains a complex picture for US equities.