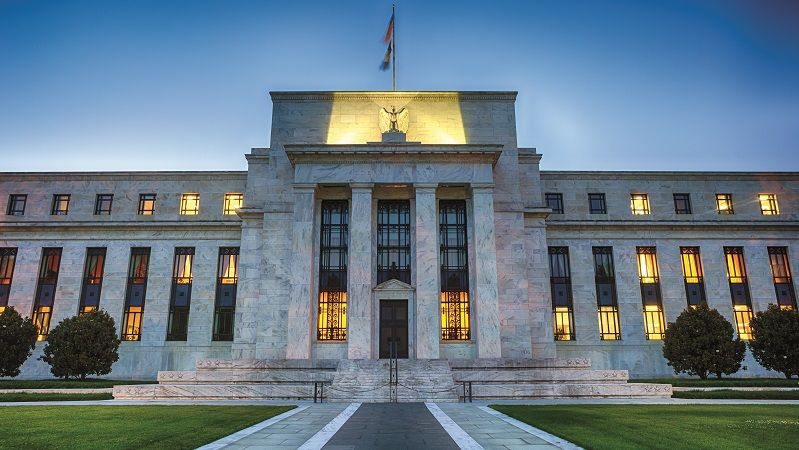

The Federal Reserve held the US base rate steady again last night at a 22-year peak of 5.25–5.5%, as widely expected, writes Alex Sebastian.

While the decision to leave rates unchanged was no surprise, Chair Jerome Powell’s accompanying commentary was where the interesting elements were found.

While once again reiterating the Fed’s determination to bring inflation down to the 2% area sustainably, Powell noted that he and his colleagues will have to tread carefully as the US economy begins to show more signs of strain.

The comments were somewhat unexpected given the robust GDP growth and jobs numbers reported in the US over recent months, and the fact inflation is still above target at 3.7%.

See also: Rising bond yields: A one-off adjustment, or a warning light for investors?

Charles Hepworth, investment director at GAM Investments, commented: “A unanimous vote by Fed committee members to leave rates unchanged was as much anticipated by the markets today.

“What probably wasn’t as anticipated, was their acknowledgment that financial conditions are beginning to weigh on economic activity, given the relatively strong readings we have seen so far this year.

“This isn’t something that they have previously referenced, and it could be inferred that they believe rates have probably peaked where they are now. Although obviously they won’t commit to that,” he continued. “Acknowledging this explicitly after their hiking campaign is so obviously tautological, it might beggar belief, but that is where we are.”

See also: The trials and tribulations of investing in European equities

Tony Rodriguez, head of fixed income strategy, at Nuveen said: “With the Fed inching closer to ending rate hikes and the economic backdrop remaining uncertain, volatility will likely pick up again. We continue to believe Treasury yields should moderate and expect the curve to become less inverted, though policy rates are likely to remain elevated for some time.

“In public fixed income markets, we believe a blend of taxable and non-taxable assets is attractive. On the taxable side, securitized assets and preferreds offer non-traditional income, with yields exceeding those of investment grade bonds.

‘Optimistic on IT and healthcare’

“In equities, we’re optimistic on information technology and health care,” Rodriguez added. “Tech stocks have strongly outperformed the broader market year-to date, driven by the largest names. And their soaring share prices have been accompanied by a dramatic improvement in earnings before interest and taxes.”

Susannah Streeter, head of money and markets at Hargreaves Lansdown, noted the positive market reaction to Powell’s comments.

‘’There has been a wave of relief that the Fed didn’t rock the boat and stuck to the expected course by keeping interest rates on hold,” she said. “This has reassured investors lifting stocks on Wall Street, buoying trading in Asia and filtering through to expectations of an upbeat early session for the FTSE 100, pending the Bank of England decision.”