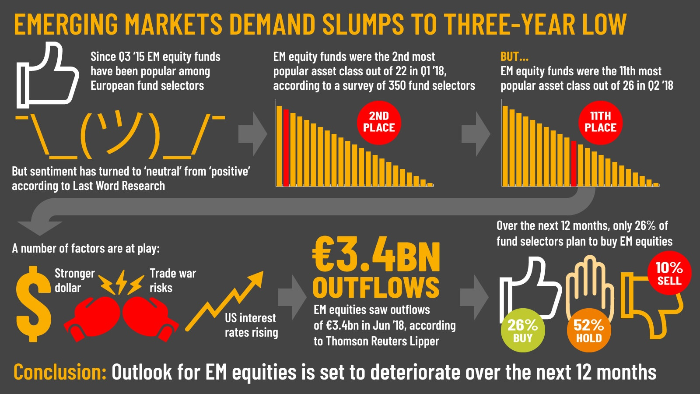

Emerging markets demand slumps to three-year low

Global emerging market (GEM) equities have been one of the most popular asset classes among pan-European fund selectors since Q3 2015 – but demand dropped dramatically during Q2 2018.

Global emerging market (GEM) equities have been one of the most popular asset classes among pan-European fund selectors since Q3 2015 – but demand dropped dramatically during Q2 2018.

Iberian fund selectors’ appetite for index-tracking products took a sharp dip in the first quarter as volatility shook the markets.

US dollar denominated money market funds topped the charts in terms of inflows for January this year, while UK sterling funds saw the biggest outflows from this sector, according to the latest Thomson Reuters Lipper data.

European investors increased their risk appetite in 2017, recording high inflows into pure equity funds compared to outflows in the previous year, helped by a big rush into passive equity funds, according to a Thomson Reuters Lipper report.

US equity exchanged traded funds (ETFs) were the preferred product for European investors looking at the ETF market in 2017, accounting for 15% of the market’s assets under management (AUM), according to Thompson Reuters Lipper research.

Net sales of equity ETFs fell dramatically in August, according to Lipper data. Net flows into eurozone equity ETFs showed the biggest drop, falling into negative territory.

Unconstrained bond funds have seen almost unconstrained inflows this year, according to Morningstar data. While more than 40% investors in Europe don’t use such funds, those who do invest in them tend to like them a lot.

US equity ETFs saw net outflows of €1.3bn in April, in a sharp reversal from the previous month when it was the best-selling asset class overall, Lipper reported. European equity ETFs, by contrast, enjoyed huge inflows on the back of macro(n)economic optimism.

Equity funds suffered their first annual weekly outflows from US investors since the election of Donald Trump, according to Lipper fund flows data.

US inflation-linked bond ETFs saw record inflows in February, according to Lipper data. European investors are taking advantage of break-even inflation rates that are lower than they probably should be.

Donald Trump’s election victory has triggered an almost unprecedented move into US equities. According to Lipper fund flows data, American investors funnelled a record net sum of $27bn to US equity ETFs during the seven days after the election.

There are now for the first time more multi-asset funds than bond funds for sale in Europe, according to statistics released by Lipper.