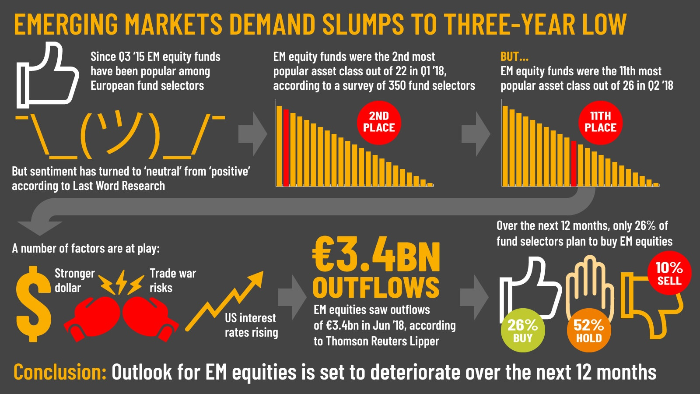

According to Last Word Research, the asset class has now moved into neutral sentiment territory after being in positive territory for almost three years.

In Q1 2018, GEM equities were the second most popular strategy out of 22 asset classes for fund selectors to purchase over the next 12 months, however, in Q2 GEM equities dropped to 11th out of 26 asset classes.

Over the 12 months to June 2019, just 26% of fund selectors are looking to buy GEM equities; 52% want to hold; 10% to decrease (10% of respondents did not use the asset class).

[visualizer id=”7589″]

Source: Last Word Research

The MSCI Emerging Market index has been on a downward trajectory since the global market sell-off in January 2018.

MSCI Emerging Market index year to 23 July 2018

Source: FT

This sentiment has been mirrored by the latest Thomson Reuter Lipper European fund flows report that found that GEM equity funds suffered the highest net outflows apart from money market funds in June at €3.4bn, followed by global USD hedged bonds at €2.7bn, European equities at €2bn, global high yield bonds at €1.4bn, and absolute return medium EUR at €1.8bn.

Source: Thomson Reuters Lipper

Outflows for European funds

The report noted that June 2018 was the second month with net outflows of €38.3bn from long term mutual funds after 16 consecutive months of net inflows.

“European investors pulled back further from long-term mutual funds as the market environment and general sentiment turned negative,” the report said.

“That said, European fund promoters still enjoyed net inflows into mixed-asset funds (€3.4 bn), followed by real estate funds (€1.1 bn) and commodity funds (€0.2 bn).”

Source: Thomson Reuters Lipper

US sentiment jumps

According to the Lipper report, the top sector in terms of inflows was US equities (€2.3bn), again mirroring Last Word Research’s latest data that found that US equity sentiment jumped into low neutral territory after being in negative territory since Donald Trump won the presidential election in November 2016.

Mixed-asset USD balanced funds followed at €1.5bn, then mixed-asset GBP balanced at €1.4bn, alternative market neutral equities at €1.4bn, and global equities at €1.3bn.

Source: Thomson Reuters Lipper