Asia’s fund selectors like slumping Chinese equities

In the next 12 months, allocations to China equity funds will be up while US and European equity exposure will decrease, according to data.

In the next 12 months, allocations to China equity funds will be up while US and European equity exposure will decrease, according to data.

European fund buyers are turning away from hedge funds amid concerns about developed market bond yields

US dollar currency speculation has led one fund selector to increase their allocation towards emerging market debt

Emerging market debt sentiment has suffered recently due to a few problem countries but opportunities still seen

Appetite for absolute return strategies still high despite underperformance but Gam fiasco may test investors’ patience

The long/short equity hedge sector has lost about 6.6% over the last three years, according to FE Analytics

We look at outlook of European fund selectors. Which countries have the bleakest outlook and which assets are they shunning?

Inflows into unconstrained bonds plummet amid concerns about illiquidity in asset class as Swiss asset manager Gam freezes fund

Sentiment towards emerging market equities among fund selectors across Asia has declined significantly following similar slump among European selectors, according to Last Word data.

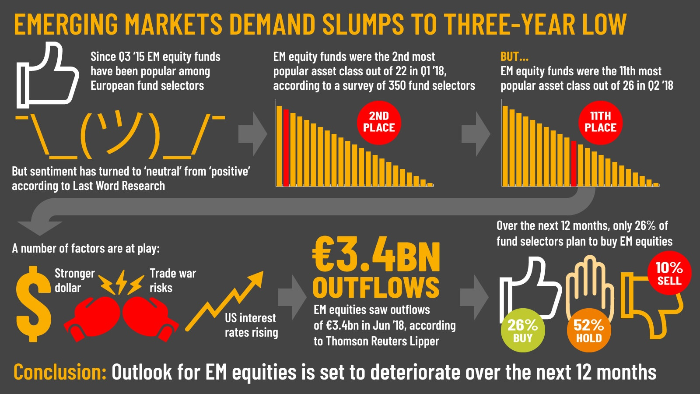

Global emerging market (GEM) equities have been one of the most popular asset classes among pan-European fund selectors since Q3 2015 – but demand dropped dramatically during Q2 2018.

More than two thirds of European fund selectors are willing to suffer one year or more of underperformance in an environmental, social, and governance (ESG) strategy, according to our research.

European fund selectors have been overwhelmingly bullish on absolute return strategy funds as a response to market volatility – but they could have made more returns if they took the risky option of US equities.