EU firms passporting to run till 2022 in event of no-deal

Backstop plan proposes that in the event of no Brexit transition period passporting rules will continue for further three years

Backstop plan proposes that in the event of no Brexit transition period passporting rules will continue for further three years

Total fund sales for the first half of year across Europe was €59.8bn about six times lower than €362.4bn first-half sales in 2017. But ETF market share hits record high, according to Thomson Reuters Lipper data.

Columna Commodities fund pretended to invest in range of commodity-linked assets when in reality the bulk of money invested in the Sicav sub-fund had been loaned to a Hong Kong shell company.

Fund distribution platform claims move will provide more transparent and cost-efficient way to access funds.

Amsterdam-based Kempen Capital Management has announced that all of its funds will be tobacco-free by the end of the year.

One of the challenges Europe has attracting international investment is the relative weakness of its tech sector compared to other parts of the world, according to UBS Asset Management.

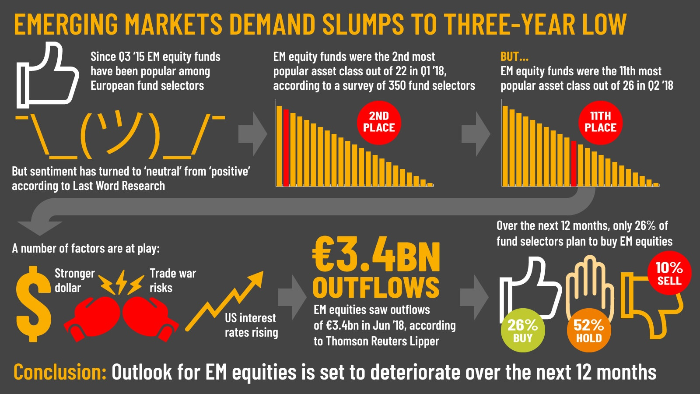

Global emerging market (GEM) equities have been one of the most popular asset classes among pan-European fund selectors since Q3 2015 – but demand dropped dramatically during Q2 2018.

Germany’s open-ended real estate funds attracted more than €6.7bn net inflows last year and investment activities rose to €9.2bn – an increase of almost 50% compared with 2016, according to Scope research.

Britain’s Financial Conduct Authority (FCA) has told regulated firms in the country to prepare for the UK to crash out of the European Union with a “no deal” Brexit.

Pan-European fund selector sentiment towards US equities has moved up into the low to neutral territory from a negative position according to latest Last Word Research.

Ecowarriors could have double the reason to celebrate the global push to eradicate plastics after Legal & General Investment Management highlighted the negative impact lower demand will have on the oil and petrochemical sectors.

Index-traded Ucits fund will invest in 30 blue-chip companies on DAX index and has total ongoing charges of 10 basis points.