Solid issuer fundamentals today and tighter bank regulations to come should combine to provide a credit tailwind

High-quality preferred securities, primarily issued by investment-grade-rated companies, currently offer 7% to 9% yields – considerably greater than what is available from investment-grade corporate bonds. As Chart 1 shows below, yields on over-the-counter (OTC) and contingent capital (CoCo) securities, which compose more than 80% of the market, are generally much higher than those on exchange-listed issues.

Better value exists today in OTC securities – partly for this reason but also on account of their fixed-to-reset structures, in contrast to exchange-traded issues, which are largely fixed rate in perpetuity. With the periodic payment resets of OTC preferreds, just the passage of time – if we experience ‘higher for longer’ rates – should lead to significant increases in income for investors if the securities are not called.

Chart 1: Preferreds’ income levels are very high in historical context

Notes: Yield to maturity (%), January 2014–October 2023. Source: ICE BofA, Cohen & Steers as at 31/10/23

Most OTC preferreds’ reset spreads are in the range of 250-400 basis points. Many reset over short rates, such as the secured overnight financing rate (SOFR), while others reset over longer benchmarks, such as five-year US Treasuries. As of 31 October 2023, SOFR was 5.4%, while five-year treasuries yielded 4.8%. So, securities resetting today would offer rates in the 7.5% to 10.0% context – generally much higher income rates than they currently pay. This makes shorter-reset issues particularly attractive ‘paid-to-wait inflation-beaters’ in the near term.

Right to redeem

Issuers also have the right to redeem the securities at par value at the reset date – however, with many shorter-reset securities currently trading at discounts to par, a redemption would only increase these securities’ total return. And if a security is called, investors can then use the proceeds to invest in issues that are most likely yielding more.

High-yield bonds and leveraged loans (also known as floating-rate loans or bank loans) have been strong performers of late – in part because they too can offer lower interest rate sensitivity. Floating-rate instruments have benefited investors in a rising-rate environment but, while high-yield bonds and leveraged loans offer greater pre-tax yields than preferreds, they are (as a market) substantially lower-quality investments. The high-yield market, for instance, has a B+ average rating, described as “highly speculative” by the rating agencies.

Remember, too, that most preferreds pay qualified dividend income, which for US investors in the highest tax bracket is taxed at just 23.8%. This favourable tax treatment can effectively eliminate high-yield bonds’ pre-tax income advantage.

Yield spreads indicate value

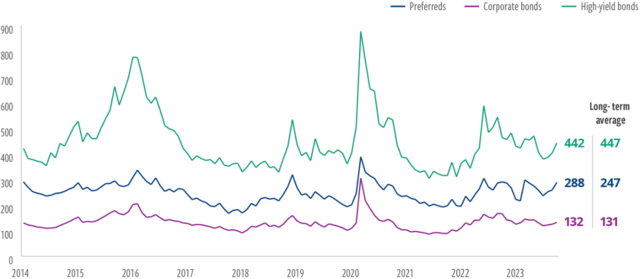

As Chart 2 illustrates below, spreads on investment-grade bonds and high-yield bonds are currently near or below their historical averages. This likely reflects higher all-in yields on bonds, given higher treasury rates. It also reflects expectations that the current economic slowing is unlikely to result in recession.

By comparison, the spread on the preferred index remains wide of its historical average, after widening meaningfully earlier in the year. Given their pricing, preferreds may be viewed as having more attractive relative value than investment-grade and high-yield bonds. As such, preferreds also have greater capacity to absorb potential downside – whether that comes from higher interest rates, a weaker credit environment or both.

Chart 2: Preferreds appear more attractively priced than high-yield bonds

Notes: Option-adjusted spreads, January 2014–October 2023. Source: ICE BofA as at 31/10/23

Given what has happened with interest rates over the past couple of years, discounts to par values exist across the fixed income market. Although preferreds have partially rebounded from their March lows, they continue to trade at meaningful discounts.

Historically, the OTC and CoCo markets have both traded at a premium, while the retail market has traded at only a slight discount. As such, current prices present a potential capital appreciation opportunity in preferreds (in addition to the securities’ attractive income rates); any reversion to the mean, potentially spurred by more clarity around Fed policy, would imply an appreciable price move.

Greater clarity

Bank earnings reports over recent quarters have gone a long way toward calming investor concerns about the banking sector. Our own view is that idiosyncratic fundamental challenges drove recent bank failures – the failed US regional banks experienced substantial deposit flight, putting investors on edge about funding stability.

Funding pressures have eased, however – deposit outflows peaked in the first quarter of this year and have stabilised since then. Industry challenges remain, so security selection is important. That drives our positioning within US banks primarily toward the largest banks and (to a lesser extent) the largest super-regional banks.

Almost all banks have strengthened capital this year through retained earnings, lower stock buybacks and balance sheet optimisation. Capital building should continue as banks prepare for higher capital requirements, more stringent regulation and macro uncertainty. The capital improvement story is nuanced, as some banks have large unrealised losses on their security portfolios – a consideration in our own security selection.

While industry deposits have stabilised, this has come at a higher cost to the banks, given the competitive funding landscape. That pressures the spread between asset yields and funding costs – known as the ‘net interest margin’. Banks with strong funding profiles, granular deposit bases and low loan-to-deposit ratios should have more resilient net interest margins.

Credit quality, while weakening somewhat, continues to be healthy, with loan charge-offs still below longer-term averages for all areas except certain commercial real estate (CRE) portfolios. Banks are tightening lending standards and proactively building reserves for future loan losses as they prepare for a slower economy.

Regional lenders tend to have much larger concentrations in CRE loans than the largest banks. For our part, we consider these CRE exposures in relation to capital levels – and we note risk-mitigating factors, such as reserves taken against parts of their CRE books, CRE composition (for example, most areas of CRE lending have much healthier profiles than office), loan-to-value ratios and maturity schedules.

In addition to favouring larger, high-quality banks, we generally like insurance companies and non-financials, such as utilities and telecom companies. As mentioned previously, we also like resetting payment structures that can take advantage of the rising-rate environment.

Reaffirming resilience

The Federal Reserve’s latest annual bank stress test results confirm that the banking system appears strong. The stress tests evaluate how large banks are likely to perform under hypothetical economic conditions. All banks tested maintained capital ratios significantly above minimum requirements in the modelled scenario of severe global recession.

Under the severely adverse scenario, the aggregate ‘common equity tier 1’ capital ratio of the 23 banks tested fell from an actual 12.4% in the fourth quarter of 2022 to a minimum of 9.9% before rising to 10.5% at the end of the two-year projection horizon. The 2.5 percentage point aggregate decline exposed in this year’s test was smaller than the aggregate decline of 2.7 percentage points last year – though comparable to aggregate decreases in recent years.

Banks, the largest issuers of preferreds, are highly regulated companies bound by strict safety and soundness requirements. After the global financial crisis, those requirements increased significantly, and the market had 13 years with no meaningful defaults. Unfortunately, the requirements were eased on the heels of deregulation passed by Congress in 2018, a move that directly influenced the events of this year. (Similarly, the 1999 repeal of Glass-Steagall, which had strictly limited investment banking activities, preceded the global financial crisis). Still, regulation is set to harden meaningfully again, and this should result in another extended period of very low default rates.

In late July, US bank regulatory agencies announced a proposal to increase resilience in the banking system. To be phased in by 2028, the measures would implement the previously planned final components of the international Basel III agreement and include the material changes in response to the banking turmoil earlier this year.

The plan would result in increased capital requirements and more rigorous standards applied to a wider set of banks. One aspect of the proposal calls for a shift from internal models for calculating risk-weighted assets to a ‘standardised’ methodology. On balance, this change would increase capital requirements by 5% to 20%, depending on the bank.

The proposal would also require all banks with total assets of $100bn (€92bn) or more to include unrealised gains and losses from certain securities in their capital ratios. Indeed, the previous relaxation of mark-to-market rules – stemming from 2018 deregulation edicts – significantly contributed to the bank failures earlier this year, as not marking securities to market allowed large capital holes to form over time as rates rose.

While implementing all aspects of these proposals will take time, we believe the additional measures could provide a profound tailwind for bank preferred holders (and creditors in general), just as the harsher regulatory requirements did for many years following the global financial crisis.

When the Fed stops hiking …

With inflation and growth slowing and monetary policy in restrictive territory, the Fed is likely at or near the end of the most aggressive hiking cycle in four decades. Historically, when the Fed stops hiking rates, short and long rates tend to fall over the following quarters, causing fixed income markets – particularly preferred securities – to perform well because the end of the cycle is associated with inflation moderating. Moreover, growth usually decelerates, causing investors to anticipate the Fed’s next move will be to cut rates.

Of course, cycles can differ, and short rates could come down slowly this cycle as inflation, while no longer out of control, could be ‘sticky’ and remain above the Fed’s 2% target for some time. What is more, the aggressive central bank tightening in recent quarters has the potential to lead to a recession – indicating it makes sense to own quality and be somewhat cautious around credit.

In conclusion, we favour preferred securities with good reset structures that can benefit from higher rates when their dividends reset. In the near term, securities with shorter terms to the reset (including floating rate issues) could fare best as rates remain high. That said, securities with longer terms to reset (higher durations) could be poised for the strongest total returns over the intermediate term.

Bill Scapell is head of fixed income and preferred securities; Elaine Zaharis-Nikas is senior portfolio manager for fixed income and preferred securities portfolios; and Jerry Dorost is a portfolio manager for fixed income and preferred securities portfolios at Cohen & Steers