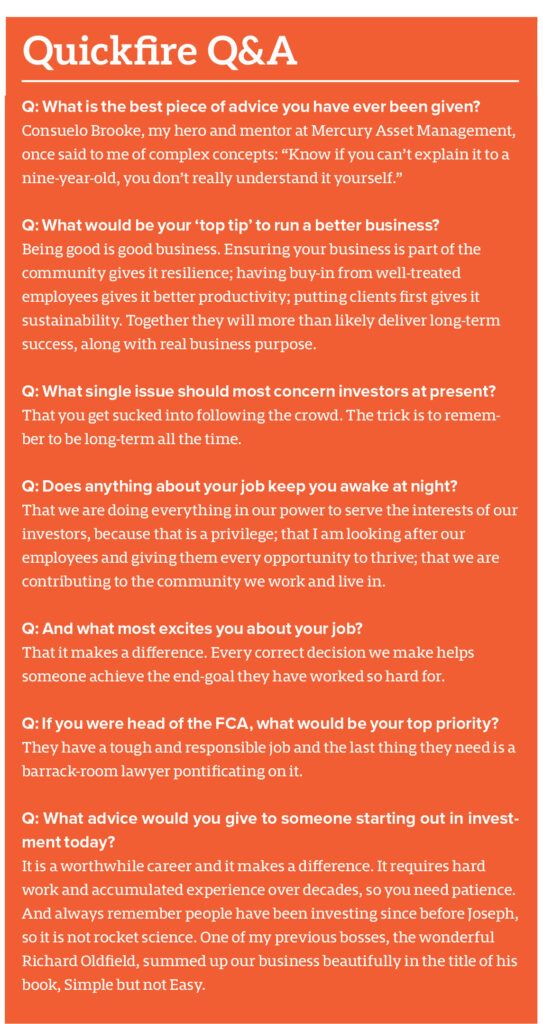

Mark Knopfler-based investment analogies don’t crop up very often so let’s start there. Federated Hermes Limited CEO Saker Nusseibeh – a self-confessed “really bad guitar player”, who used to busk while at university in London – mentions the six-string virtuoso and former Dire Straits frontman as he highlights a fault-line between asset management’s twin commercial imperatives of attracting new clients and doing right by existing ones.

“There is a tension between what businesses often think – that they need to attract clients by acquiescing with the general belief trading is the way to make money – and what most people in the industry instinctively know, which is that trading actually does not make you money,” he says. “The ‘hit’ ratio for trading – and certainly many academic papers have shown this over the years – is so bad.

“To really make a difference in our industry, you have to invest for the long term – 10 years should be your time horizon – but that often goes against the approach of the consultant and fund-picker communities and anyone who only looks at three-year and one-year numbers. And where I worry about this tension is that it is only the very privileged who end up being on the right side of it as they are able to sit on very long-term strategies.

“Meanwhile the less privileged are encouraged to chop and change and focus all the time on short-term returns and short-term fees – as opposed to net fees, risk-adjusted – or they get pulled down the road of beta through index funds. To be clear, there is nothing wrong with index funds but, as my predecessor Ralph Quartano worked out 40-odd years ago, the whole point is you need to engage with the underlying stocks.

“Now, clearly some asset managers can make money by short-term trading but that skill is rare – and skill is the issue, right? It is the same with music. I mean, I play the guitar – really badly! – but there are only a few truly skilled guitar players in the world. If you have ever listened to Dire Straits, you know Mark Knopfler is really playing – but there is only one Knopfler.

“Yet most of the asset management industry is essentially saying, Oh, anyone can be Mark Knopfler – that investors can just follow the prevailing market view that all you have to do to make money is trade different funds from time to time – when, in reality, the ability to do that successfully is extremely rare and everyone should be looking to invest over the long term.”

Screen off

Nusseibeh, who in 2009 joined the then-Hermes from Fortis Investments as CIO and was appointed CEO three years later, peppers his conversation with anecdotes about colleagues past and present – and here takes the opportunity to mention a formative experience from his first job. “I started my career at Mercury in March 1987 – an opportune time! – and they assigned James D’Albiac, an amazing UK investor, to ‘uncle’ me.

“That October, as the crash was happening, I am on the trading floor and everybody is running around as if their hair is on fire – except James. He gets up, switches off all the screens, which in those days were wall-mounted, returns to his desk and says, ‘Don’t panic. It’s just noise.’ And of course, in pure investment terms, he was right – if you could ‘switch off the screen’ so to speak then, 10 years later, it was just noise.”

For Nusseibeh, this ability to think long-term and not be affected by market noise “makes the difference” – particularly in the context of what he sees as a crucial question for businesses. “What is our purpose as asset managers?” he says. “Yes, strategies and risk management and so forth are important but, if you strip it down to the absolute basics, our purpose is to help ordinary people retire better.

“Individual investors are at the heart of everything we do – and have done. After all, Hermes started life in 1981 as a fund manager for British Telecom and Post Office pensioners and, for my first few years with the business, I was privileged to sit on the investment committee of what was the then-BT Pension Scheme Management. That meant I spoke to scheme members who represented the pensioners, which is what this game is all about.”

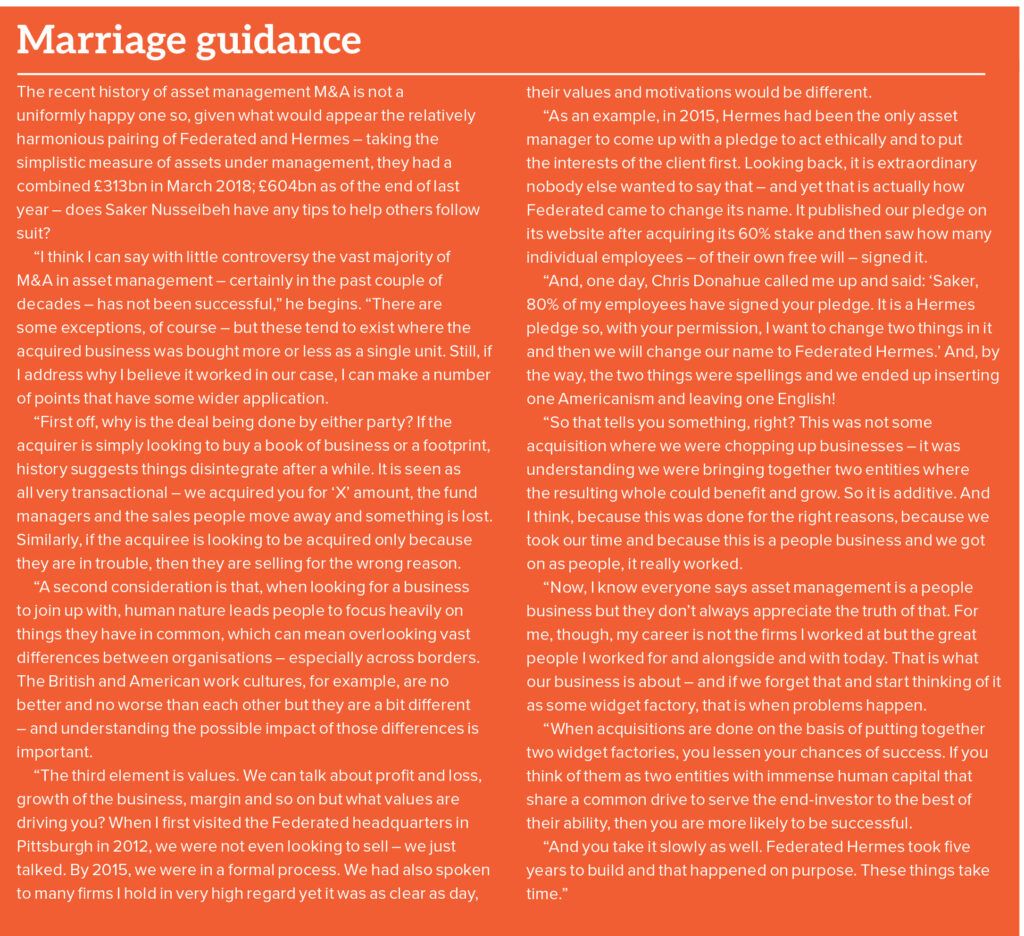

How Hermes went on to link up with US investment giant Federated is not the usual story of asset management M&A – as evidenced, first, by the time it took to come to fruition and, second, by Federated Hermes Inc CEO Christopher Donahue’s description of the deal as “a reverse transformational acquisition”. “That tells you it wasn’t simply about acquiring a book of business,” observes Nusseibeh.

Heart and soul

“How we got here is that, when I turned up at Hermes, it was clear a time would come when there would be a slight conflict in terms of how and where to invest assets. We had one client who was the total owner of our business and whose assets were ultimately on a maturing path – but we also had a growing number of clients we needed to service and they had different priorities.

“So I asked the board if we could take the third-party assets and look for a new home that would maintain the heart and soul of the old Hermes – the centrality of the individual investor and the way we approach sustainability as a way of enhancing returns long-term – and taking that to a new dynamic. It took a number of years – and it took us talking to Federated, in fact, from 2012 to 2018 – before we finalised things.

“That was because our values were actually quite similar and, in 2018, Federated acquired 60% of us while 40% remained between the BT pension scheme and some shadow equity for management. Over time, that was taken up to 100%, which has been beneficial for many reasons. For a start, Federated has a long history of essentially being a trust company and looking after people’s investments in the fiduciary sense of the word.

“It also has a large money-market business – an area that is often dismissed in the UK but is incredibly resilient – and that resilience allows the firm to invest in things that enhance returns to individual savers whose money we are entrusted. That is always worth keeping at the heart of things. Asset management is a serious business – we are dealing with people’s futures. It is not a job – it is a responsibility.”

The stories we tell

People are central to Nusseibeh’s take on company culture and brand, too. “From the earliest days of the BT pension scheme, it was all about people – serving the investors and understanding that individuals make a difference,” he says.

“That even extended to the Hermes name, which was chosen by another of my predecessors as CEO, Alastair Ross Goobey.

“His view was that the pensioners are ‘gods’ because it is their money we look after and we are the messenger of the gods, so we are Hermes! I find that so interesting – even without the symmetry of starting my career at Mercury, which is also the Roman version of Hermes. And that leads to another aspect of culture – the stories we tell – because, whether it is a country or a business, culture is conveyed by storytelling, right?

“Take our first CEO, Quartano, for example, working out engagement is a good thing almost before anybody else – and then having this extraordinary insight, when there were barely any index funds in the world except for maybe $500m (£398.6m) at Vanguard, that the future was going to involve a lot of index funds and therefore proper engagement was going to be vital.

“Or his successor Ross Goobey thinking about how non-direct financial factors can lead to better financial returns. If you take that through to the work we are doing now, the Hermes story is one of constantly being at the edge of moving forward – and that is mirrored in Federated pioneering money market funds and then dealing directly with trust banks to give them a better return on their deposits.”

Measuring ‘nice’

“And when I joined the business – perhaps rather selfishly – I thought about what I valued on a personal level and I concluded, wouldn’t it be amazing if we have this firm that attracts people who are not just excellent at what they do but also nice? If you can combine excellent and nice, then a culture of transparency and accountability and allowing people to excel in their field – whatever that may be – should naturally follow.

“When I first suggested the idea, people argued you cannot measure ‘nice’ but I thought there was a route to it being about co-operation, about looking after clients, about thinking beyond your own silo. On that last point, back when I started The 300 Club in 2011, something that really annoyed me was how completely siloed people had been in the way they looked at markets before the global financial crisis happened.

“Nobody asked the right questions. Nobody went to banks and said, excuse me, you are really boring businesses that typically make 8% or 9% margins – how on earth are you making 18% now? And when people were talking about credit default swaps, nobody said, excuse me, that just sounds like reinsurance, which has been around for 300 years and is always backed by assets – so where are the assets backing these instruments?

“Most importantly, people don’t ask themselves enough, why do we do what we do? So why did we invest as we did at Hermes and now do at Federated Hermes – focusing on sustainability and engagement over the long term? We do it because we believe this enhances returns and contributes to our purpose of helping ordinary people retire better. Unless we are really thinking about the ‘why’, we can never properly work out the ‘how’.”

This article originally appeared in the May issue of Portfolio Adviser