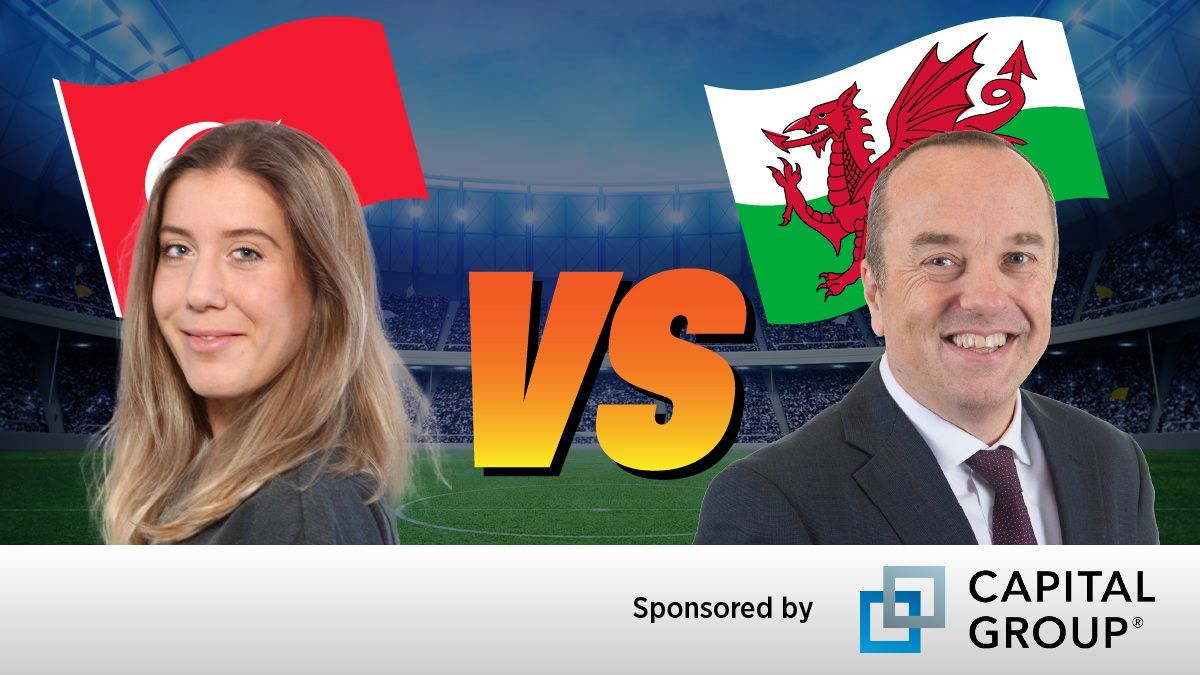

FEDERICA CLERICI

FUND MANAGER

BCC RISPARMIO&PREVIDENZA

Score prediction: TURKEY 2 – WALES 0

INVESTMENT INSIGHT:

Historically a net importer, Turkey’s economy is open to foreign trade: according to the World Bank, its trade volume amounts to 61.4% of GDP. Despite the scarcity of natural resources, this figure is in line with the average in Emerging Europe (62%).

In 2020, on the imports side, the country benefited from the decline in commodity prices, however it suffered a decline in exports by almost 18%. The IMF projections for 2021 foresee a strong rebound in the latter (+26.5%) accompanied by a slower increase in imports (+6%).

Two drivers are shaping these trends: on one hand, the rebound in economic activity in Turkey’s trade partners is pushing the external demand of vehicles and industrial goods. On the other hand, policymakers are incentivising projects aimed at reducing the country’s reliance on imports of natural gas, favouring renewables as fuel for power generation.

Turkey has 21 active free trade agreements, among which a long-dated deal with the European Economic Association (1991): Turkish exports will benefit from spillover effects brought about by the infrastructure projects of the Next Generation EU. In fact, approximately 35% of Turkish exports are attributable to the macro-category of industrial goods.

The same figure also coincides with the sector weight in the MSCI Turkey equity index, leaving room for a profitable investment opportunity, given the current discount on valuations with respect to both the historical average and the current EM average (12m forward P/E at 6.2 vs. 10y average at 8.3 and EM average at 15).

DAVID COOMBS

HEAD OF MULTI-ASSET INVESTMENTS

RATHBONES

Score prediction: TURKEY 1 – WALES 1

INVESTMENT INSIGHT:

Barry Island to the World and back

Most will link Barry Island to Gavin and Stacey, an important Welsh cultural gem. But perhaps you are less aware that Barry is also a port, albeit a small one. Wales has over 30 ports, although Milford Haven is by far the most important dotted along its coastline, in terms of tonnage.

The south-west coast of Wales has a long history in manufacturing, including the auto industry. Even now it’s rumoured Elon Musk may open a Tesla plant there. As the UK looks to adopt a broader international trade strategy, and focus on high tech and science, this region looks highly promising as it has all the components needed to attract investment. A post Brexit freeport would be a significant boost and release huge potential.

The second biggest port is Port Talbot, the birthplace of Brian Flynn, former Wales Under-21 manager, and credited with an important role in developing some of the current squad including Gareth Bale and Aaron Ramsey. Of course, it’s also synonymous with steel and emissions. This is an area ripe for re-generation. Swansea is just 15 minutes away along the M4- the town has a mainline station and the harbour is under-utilised. Unemployment has been stubbornly high for a generation, so labour should not be a barrier.

Renewable energy is rapidly emerging as key local industry. The opening of the Margam Green Energy Plant, owned by Glennmont Partners, is encouraging, as are the commissioned Lynfi Afan and Mynydd Brombil onshore wind projects. There are also schemes in biomass and solar in the pipeline. The area should attract more ‘green capital’ and the local economy could finally take its place in the sun, which, by the way, you can now see as emissions fall…