Fund buyers dump absolute return in droves

Sentiment towards asset class at all-time low as outflows hit €7bn in September following Gam saga and volatility rise

Sentiment towards asset class at all-time low as outflows hit €7bn in September following Gam saga and volatility rise

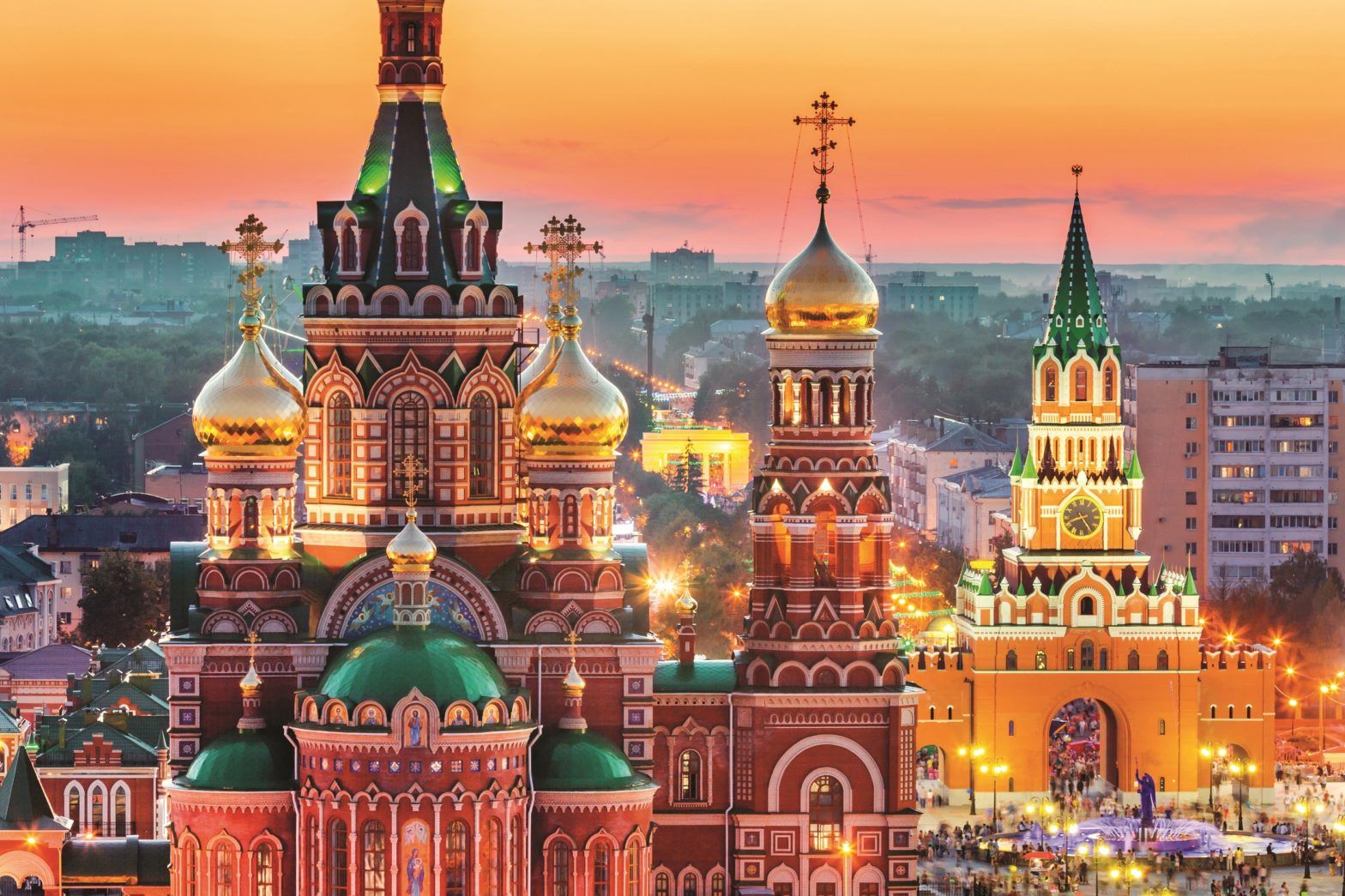

Rating agencies at odds with UN body over ESG definition, EC sustainable framework decision key

The sanctions can make investing in Russia a bumpy ride. But there are still attractive returns to be found

It is more likely that passive funds will survive and generate a return in excess of their average active peers, according to Morningstar

Ratings agency has launched new Global Sustainable Finance unit as Morningstar prepares to revamp its sustainability fund ratings system

Rising equity markets push AUM in open-end funds to record highs as passive funds see highest inflows since February

Cheapest US equity funds have produced better returns compared to pricier active peers, according to Morningstar

Investor consensus pegs recession for Q1 2020

Find out the five bottom funds from the sector which has seen €12bn of outflows in this year

Emerging market debt sentiment has suffered recently due to a few problem countries but opportunities still seen

Appetite for absolute return strategies still high despite underperformance but Gam fiasco may test investors’ patience

It is only the second time in the past five years have net inflows have exceeded €30bn in any six-month period.