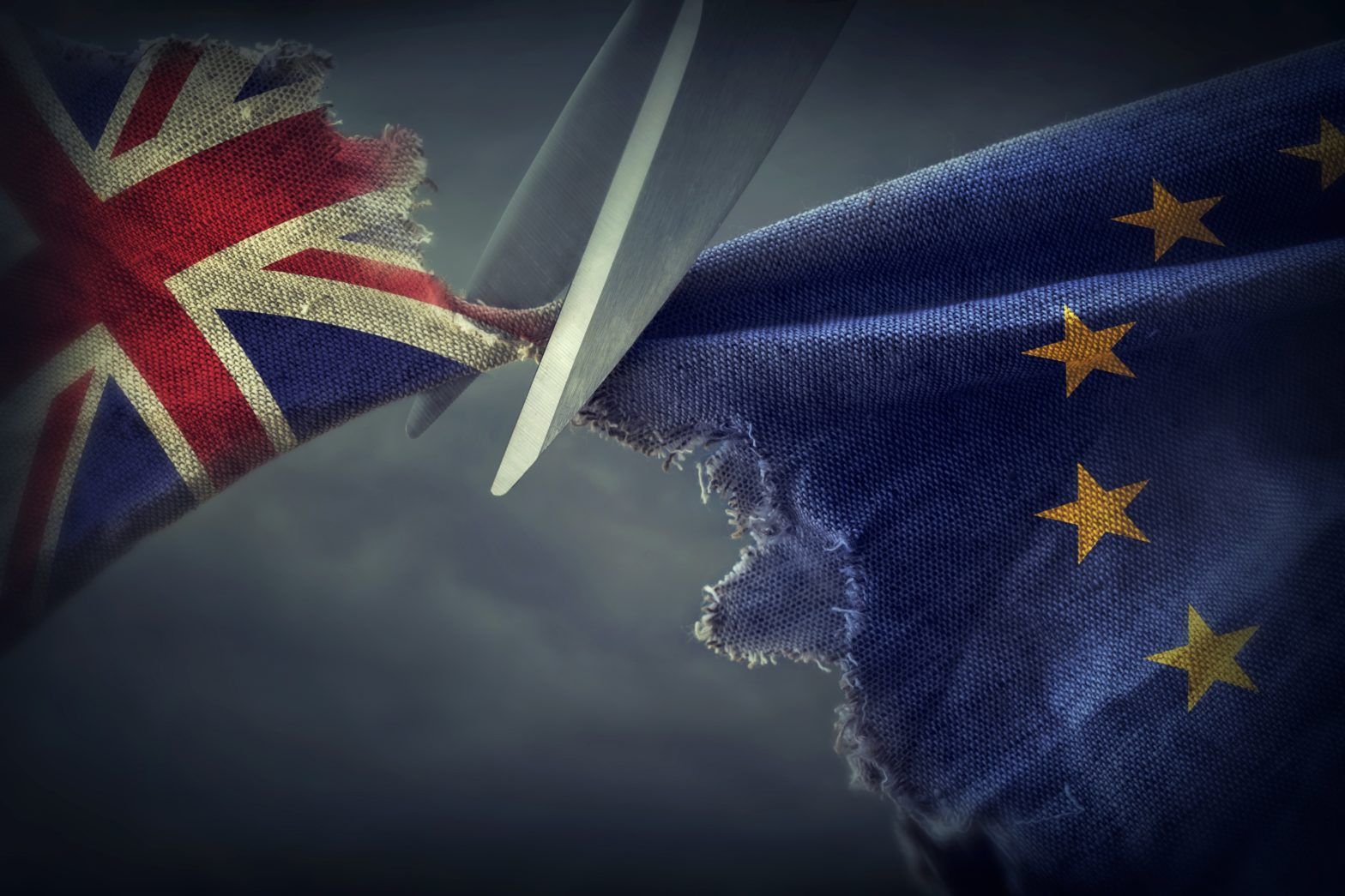

M&G Prudential spends €32m preparing for Brexit ahead of demerger

Prudential’s life and asset management business eyes opportunity in private markets

Prudential’s life and asset management business eyes opportunity in private markets

Once companies have raised capital they may not be engaged with bond holders for many years

Currently the firm’s mixed asset strategies hold more cash than fixed income

The government’s row with the EU has scared investors but valuations look attractive and earnings could soon rise

Micaela Forelli appointed head of European distribution in Luxembourg as British asset manager ramps up European presence

To navigate the hazards of the bond markets, one fund manager looks to US and emerging market debt for value while a fund selector finds opportunity in alternative fixed income.

M&G Investments is planning to transfer €39.1bn (£34.2bn) worth of non-sterling UK assets to Luxembourg to hedge against possible risk ahead of Britain’s exit from the European Union.

UK fund manager M&G Investments has begun to transfer the assets of four UK-domiciled open-ended funds with assets of around €10.5bn (£9.3bn) to equivalent funds on its Luxembourg platform.

M&G Investments has launched an ESG-screened global high yield bond fund, the company’s first venture into the area of responsible investing. The fund will be co-managed by the same duo that already manages M&G’s conventional global high yield bond fund.

Above everything else, Marta Campello of the Spanish wealth manager Abante Asesores wants fund managers to be transparent. And if they are, that could make the difference between being ditched and being given a second chance.

Many fund managers dismissed the historical German election results as “insignificant for markets”. But they fail to take into account the fact that these elections have upended the status quo, possibly triggering a reversal of recent political trends.

M&G is transferring four UK-domiciled open-ended funds to its Luxembourg platform over fear and uncertainty surrounding the UK’s exit from the European Union.