Luxembourg selectors look to GEM and Asia equities

As buying sentiment towards GEM and Asian equities trends lower, Luxembourg selectors take the opposite view

As buying sentiment towards GEM and Asian equities trends lower, Luxembourg selectors take the opposite view

Reducing the carbon footprint in a portfolio through ESG screening alone seen as box ticking exercise

Ucits assets seen quadrupling to €42trn by 2048 but fears illiquid sectors may spark crash

Swiss buyer Reyl hopes acquisition – which increases its AUM by €800m – will boost its business in Nordics

David Mapley seeking to become director of Luxembourg-domiciled umbrella fund behind failed Columna Commodities Fund

CSSF ‘needs to intervene’ to shore-up Luxembourg’s reputation after ‘grossly negligent’ actions by Sicav fund directors

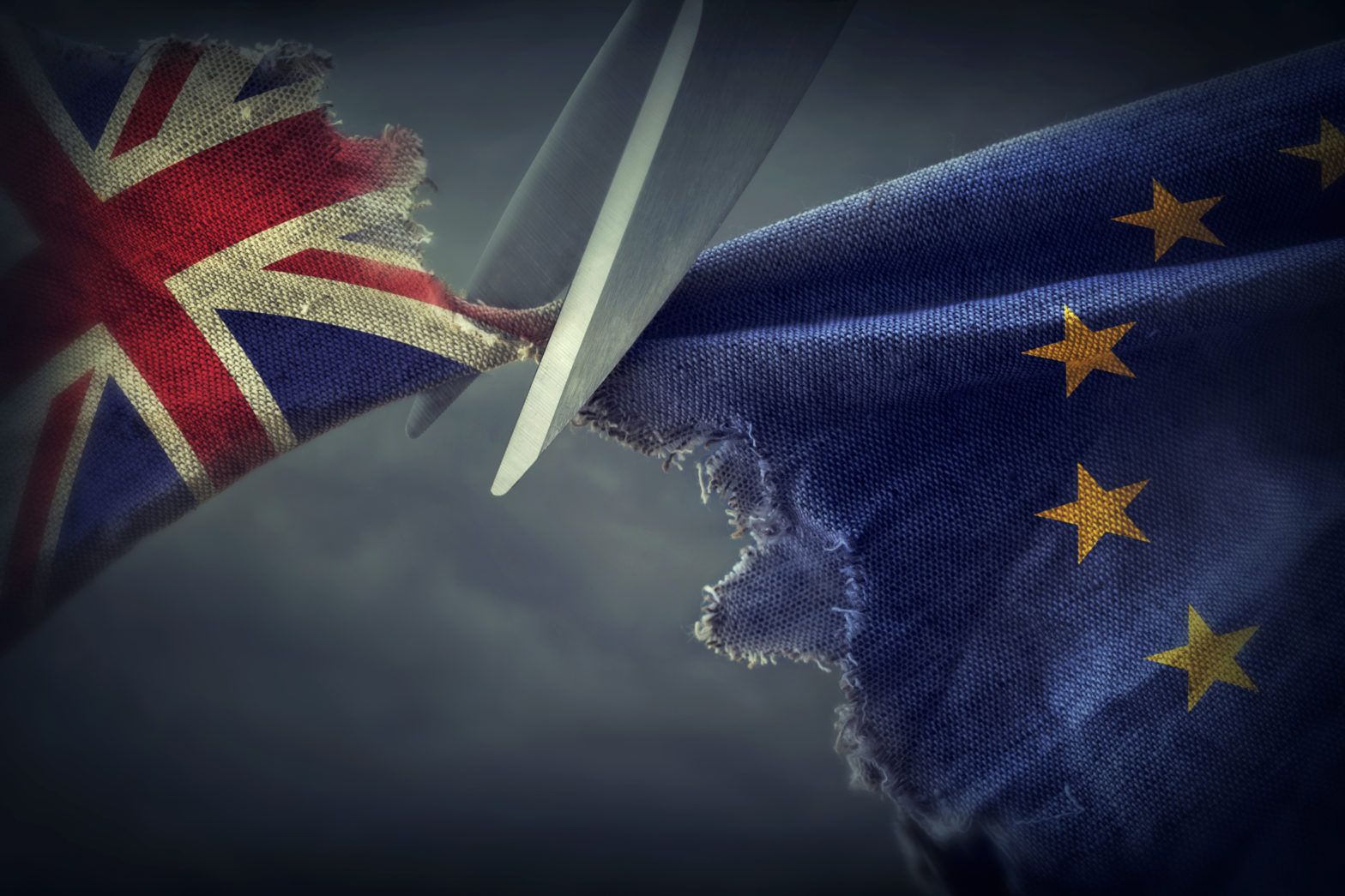

The move to expand Luxembourg-domiciled fund range comes at a time when many asset managers are rejigging their international distribution strategies as Brexit looms.

Columna Commodities fund pretended to invest in range of commodity-linked assets when in reality the bulk of money invested in the Sicav sub-fund had been loaned to a Hong Kong shell company.

Most global asset managers with London operations have begun revising their distribution strategies to ensure continued access to the EU as Brexit looms. But where are they are going?

The private bank has received regulatory approval to operate a wealth management subsidiary in Luxembourg.

In response to the eurozone’s first quarter drop in growth and the European Union’s discord over how to handle migration a German fund selector has reduced European equity fund allocations.

Luxembourg and Ireland top jurisdictions set to benefit from asset managers shifting operations to new locations over the next five years, according to State Street survey.