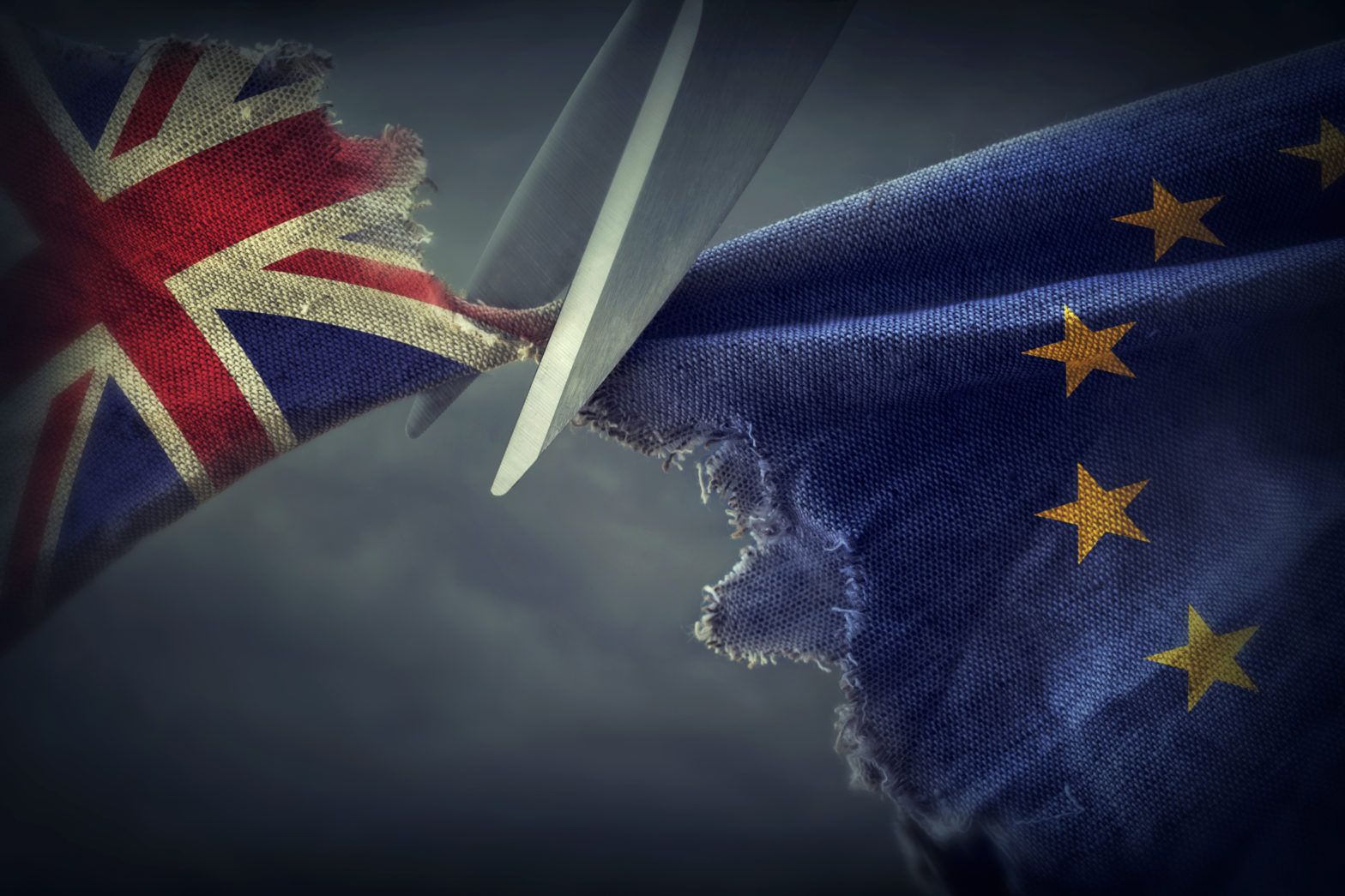

First State makes Ireland hires to counter Brexit risks

Four senior appointments at group’s new Irish management company will support offering to EU clients

Four senior appointments at group’s new Irish management company will support offering to EU clients

Damian Barry will seek to develop multi-asset strategies at Irish group

Irish office will centralise oversight of group’s Ucits platform and support clients in the Americas, EMEA and Asia

Group says move part of effort to create a bigger fund platform for both companies and generate cost savings

Only 13% of Ucits funds may comply with new fee rules proposed by German regulator, says consultancy

New entity acts as agency broker to ensure group continues to provide services to clients based in the EU

US group looking to offer individual portfolio management services to segregated clients in the EU27 post-Brexit

Most global asset managers with London operations have begun revising their distribution strategies to ensure continued access to the EU as Brexit looms. But where are they are going?

Luxembourg and Ireland top jurisdictions set to benefit from asset managers shifting operations to new locations over the next five years, according to State Street survey.

Global asset manager Aberdeen Standard Investments (ASI) is to establish an investment and distribution business in Ireland to complement its existing Luxembourg operation and shore up its European offering ahead of Brexit.

Edinburgh-headquartered Standard Life is expected to choose Dublin as the centre for its European Union operations after the UK government completes the two years of Brexit negotiations.

On an asset-weighted basis, Nordic-domiciled funds have annual management charges some ten basis points below the European average, according to a report published by Morningstar Denmark