Inflation fears mount for fund managers

But are their concerns really warranted?

But are their concerns really warranted?

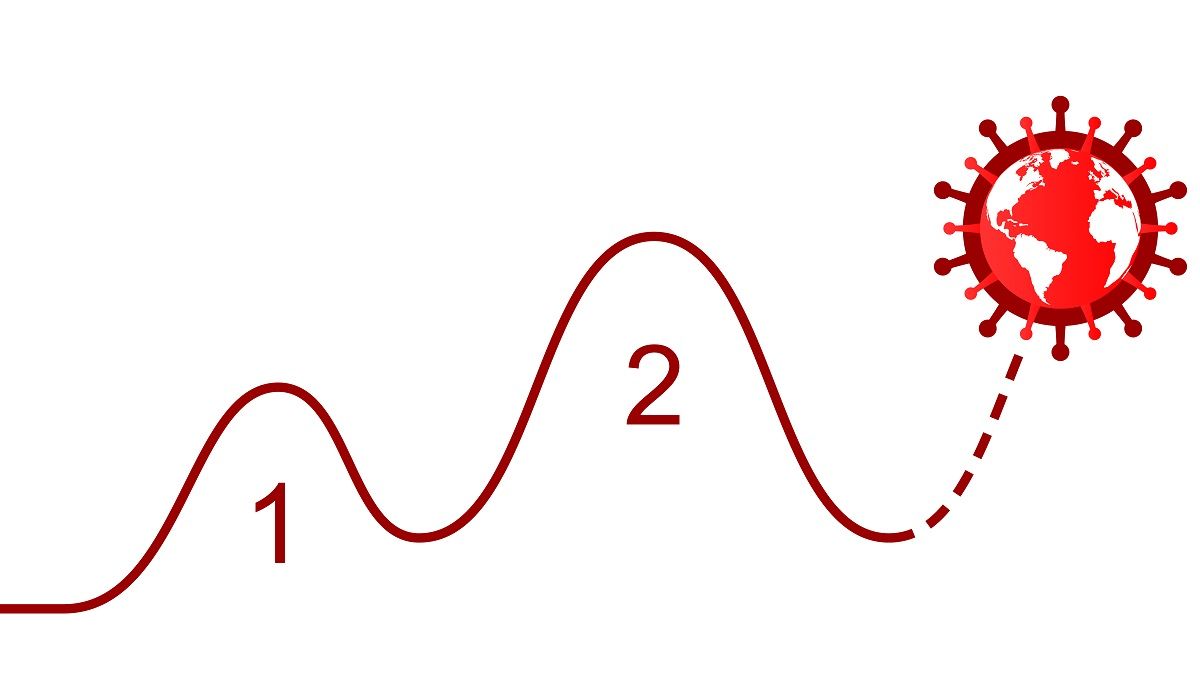

Economies and stock markets have generally been more resilient than expected in the face of repeated lockdowns

Is this a sign that European investors should back away from fixed income?

Discretionary fund managers say asset classes rather than geographies will be the best source of safety if the US unleashes a full-blown trade war.

Snowy sub-zero weather has been blamed for the first quarter fall in growth. Will the bloc rebound?

Fund managers remain bullish on Japan’s corporate earnings growth as stagnant inflation seems highly unlikely to spur its central bank into unwinding quantitative easing for at least another two years.

During almost a decade of experimental monetary policy from central banks, inflation has been notable by its absence across most economies. With monetary policy beginning to diverge and unemployment falling, will it rear its head again or has it peaked?

Inflation, or the lack of it, especially in Europe, is one of the biggest uncertainties facing the markets in 2018, according to Karen Ward, the new chief market strategist for UK and Europe at J.P. Morgan Asset Management.

The US Federal Reserve announced it will begin to unwind its quantitative easing programme in October, and said another rate hike this year is likely despite persistently low inflation.

Despite a murkier outlook for global inflation, there could be “positive surprises” ahead which make inflation-linked bonds an attractive diversifier, Fidelity International says.

Friday’s US inflation report suggests the recent streak of soft CPI inflation may be more persistent than the Fed initially believed, decreasing the likelihood of further rate rises.

It has now been a year since the UK electorate made, as a British fund manager put it recently, “a huge strategic error of the like the country hasn’t experienced in maybe a century” by voting for Brexit.