JP Morgan finds Europe lagging US and China in GDP growth

consumer confidence has begun to dip after rebounding from record lows during 2022

consumer confidence has begun to dip after rebounding from record lows during 2022

Due to strong demand for US equities

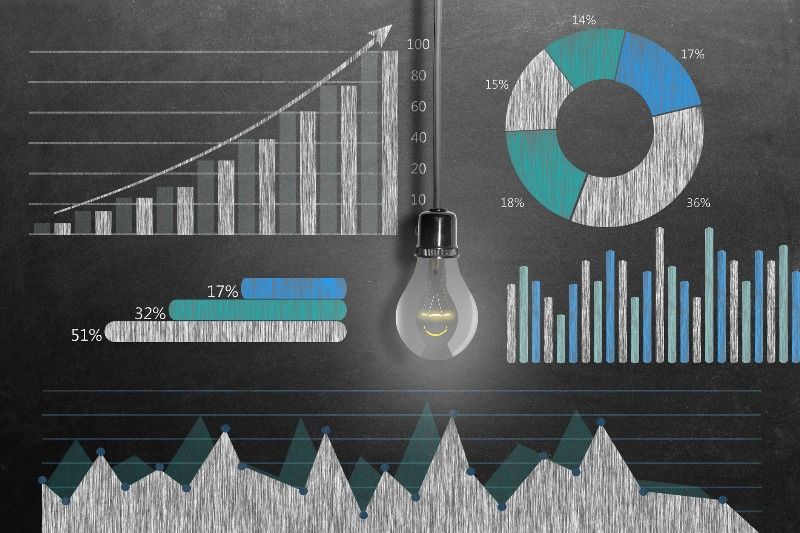

While the market can famously remain irrational longer than investors can remain solvent, analysis suggests this growth rally is thinly supported Having largely given up on organic intelligence, investors have grown all excited over its artificial offspring. As a result, the (mainly US) stocks linked to AI have raced away from the broad market this…

2022 was hailed a year of revival for value strategies, but they have been comprehensively outpaced by growth strategies to date in 2023. The MSCI World Growth index has beaten the MSCI World Value index by around 14% since the start of the year, with weaker commodity markets, economic weakness and the banking crisis all…

‘We scaled back top-down cyclical risk in our model portfolio during Q2’ says NNIP’s Moonen

Economies and stock markets have generally been more resilient than expected in the face of repeated lockdowns

‘In our opinion, the diversification benefit of allocating to value is reason enough to consider it in your portfolio’

Apple, Amazon and Microsoft appear in the top 10 stocks for three different factors

European fund selectors expressed a preference towards growth emerging market funds over value during the last six months. However, Europe’s top performing funds allocated a greater weighting towards value stocks during the period.

European small cap growth funds have outperformed rival fund categories over the last three years, and Finnish and Swedish fund selectors have led the pack in cashing in.

Growth funds have walloped their value counterparts consistently for the last decade. But with the prospect of rising interest rates on the horizon and supportive global growth, can the investment style make a comeback in the new year?

Most active US equity funds struggle to ever outperform their benchmark. But this year, the secret to outperformance has been surprisingly straightforward.