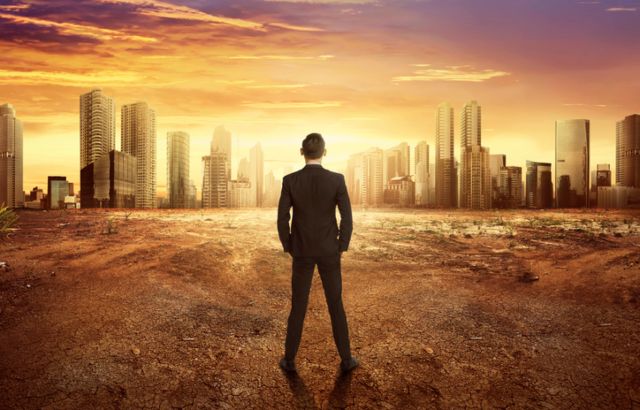

Low spreads, high inflation and rising defaults: Navigating fixed income in 2023

There is a question over whether spreads adequately reflect the outlook for the global economy

There is a question over whether spreads adequately reflect the outlook for the global economy

74% expect portfolio illiquidity to increase in the next year-and-a-half.

They were plagued by issues like managing ‘unconstrained’ strategies in ‘constrained’ vehicles, wishful thinking and back-tested results, and an aggressive hot-dot sales culture

With markets upgrading the probability of a stagflationary environment, Europe’s asset allocators assess whether to scale down portfolio risk

At launch, it will offer 10 funds investing in European, eurozone, US and emerging market equities, together with European fixed income

As Bank of England also votes to maintain at 0.1%

Investors behaving like fund managers by trading active funds opportunistically and ‘buying and holding’ index trackers

The term ‘Asian Century’ entered common usage in the 1980s, as a way of describing the region’s anticipated economic dominance in the 21st century, writes Sunny Bangia, portfolio manager at Antipodes Partners.

Cash allocations expected to drop as investors look to deploy capital

Morningstar’s head of manager selection, Ruli Viljoen, picks funds expected to deliver over the long term

Drive for improvements will stem from necessity more than choice

Agility, efficiency and aligning fragmented systems are key factors