Global fixed income managers remain positive on credit fundamentals despite higher expectations for interest rate rises in the US, according to a survey by global asset manager Russell Investments.

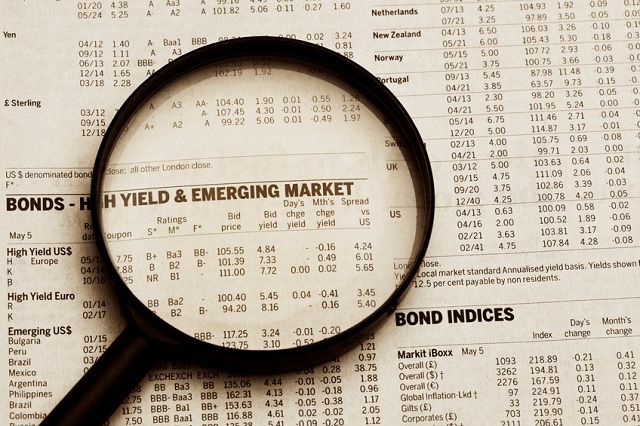

Fund managers favour high yield credit and local currency emerging market debt but remain cautious on investment grade credit, according to the Russell Investments Q1 2018 Fixed Income Survey of 70 different fixed-income investment firms across the world.

Eight five percent of fixed income managers surveyed expected three-to-four US interest rate rises over the next 12 months, according to the Q1 survey. (Most managers expected one-to-two rate hikes in the previous quarter’s survey.)

The anticipation of extra rate rates comes from rising US inflation – with managers expecting US Core CPI to be at 2.06% by Q1 2019, an increase on the expectations of 1.95% in the previous quarter.

As managers have become more bullish on the number of rate hikes left in the cycle, there is an increase in the expected terminal funds rate by the US Federal Reserve with four in 10 (42%) managers seeing a terminal range between 2.5% and 2.75%, while over eight in 10 (84%) see the range between 2.26% and 3.25%.

High yield preferred over investment grade

Despite predicting higher rates however, fixed income managers remain confident that it will not ultimately impact credit market fundamentals.

The managers surveyed favour high yield credit and remain cautious on investment grade credit. Over half of managers (56%) are cautious on global investment grade credit, compared to just 32% in the previous quarter.

Improvements to corporate fundamentals drove positive sentiment towards global high yield credit, with eight in 10 (79%) of respondents seeing modest improvements to fundamentals (compared to only 44% last quarter) and 11% seeing material improvement (compared to 0% last quarter).

Skittish investment in high yield bonds and robust demand for emerging market debt have led European fixed income fund inflows over the last year – this survey suggests that trend will continue.

David Jurca, Senior Research Analyst at Russell Investments, said: “The survey findings show that rates managers have blinked first and are adjusting their views.

“However, the key question is whether expectations of higher rates will ultimately also impact credit market fundamentals, and it appears that investors remain confident the underlying fundamentals can withstand the broader macro pressures at present.

“With the trends in inflation and interest rate views now reversed upwards, the ability to remain nimble to capture this impact on various asset classes will be important,” Jurca said.

“Market volatility is likely to remain for the foreseeable future, meaning investors should consider maintaining some dry powder, in the form of highly liquid, cash-like assets, on both the interest-rate and credit front.”

Bullish on local emerging market debt

The clear bull among fixed income subsectors remains local currency emerging market debt. Despite the strong performance already posted by this sector, more than nine in 10 (94%) of survey respondents believe that local currency is more attractive than hard currency debt on a one-to-three-year view.

However, managers remain positive on emerging hard currency debt, with 92% predicting a 2-8% return over the coming 12 months, although this is down on the previous quarter where 79% of managers expected hard currency returns of 6% to 10%+.

Last quarter, 62% of respondents expected lower EM inflation over the coming months. However, in line with predictions for increases in developed market inflation, only 14% of managers surveyed this quarter see inflation moving lower over the next 12 months.

This same trend is visible in EM local rates, where 59% of managers previously believed rates were cheap, versus only 32% feeling so this quarter. Two thirds of managers (65%) now feel EM local rates are fair value.

Additionally, surveyed managers are as bullish on EM currencies vs USD (as represented by the JP Morgan GBI-EM GD Index), as they have ever been over a 12-month horizon since the survey began in July 2016. Almost half (46%) see a strong positive from currencies, while an additional 19% see currencies as a slight positive.