Social media platforms have been under intense scrutiny for years, exacerbated by Twitter-happy former US commander-in-chief Donald Trump.

The internet has always been a hub of half-truths and outright lies, but the impact those 280 characters can wreak is now more sharply in focus.

Facebook (or Meta) founder Mark Zuckerberg and Twitter’s Jack Dorsey were dragged before the US senate judiciary committee in 2020 to explain how they are fighting fake news.

But it doesn’t seem to have been the growing public and political concern about the spread of misinformation that pushed Dorsey to step down as CEO of the company he co-founded in 2006.

He was also, simultaneously, running another company.

Unconvinced

Rumours began to circulate at the weekend that Dorsey was set to depart for a second time.

Having run Twitter for the first two years, he stepped down in 2008 to set up payment app Square, which has gone on to be incredibly successful.

He was replaced by Twitter co-founder Evan Williams, who lasted until 2010 when then-chief operating officer Dick Costelo stepped up to the helm.

Dorsey returned to the Twitter-verse in October 2015, after Costelo left the company.

The intention had been that the appointment would be on an interim basis, but he was re-appointed chief executive.

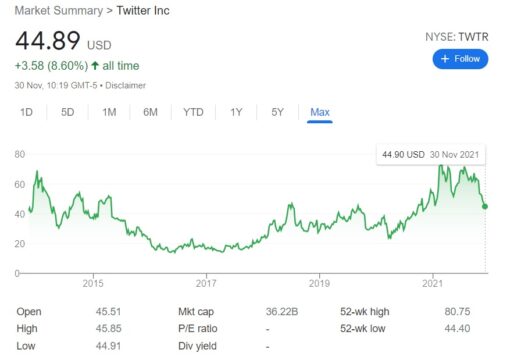

The news of his departure was initially welcomed by investors, with Twitter’s share price hitting $51.88 when markets opened on Monday 29 November, up from their Friday close of $47.02.

But that early optimism was swiftly tempered. The share price retreated to $46.85 just after midday and the slow slide continued into Tuesday.

A reasonable conclusion was that investors were pleased to see Dorsey depart but disappointed by his successor.

Who’s who?

As Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, explained: “It’s little surprise that investors initially reacted positively to speculation that [Dorsey] was leaving the platform”.

“But the initial euphoria fizzled out, as the new pick for the driving seat, Parag Agrawal, the chief technology officer, appeared to underwhelm investors.”

According to his LinkedIn profile, Agrawal has been at Twitter since October 2011, having joined as a distinguished software engineer. He was promoted to CTO in October 2017.

Prior to working at the social media platform, he had short-term research roles at Microsoft, Yahoo! And AT&T.

He holds a PhD in computer science from Stanford University, having attained a B. Tech in computer science and engineering from the Indian Institute of Technology, Bombay.

But even a public endorsement from Dorsey has done little to nudge the share price back up.

In his resignation announcement posted on Twitter, he said: “The board ran a rigorous process considering all options and unanimously appointed Parag. He’s been my choice for some time given how deeply he understand the company and its needs.

“Parag has been behind every critical decision that helped turn this company around. He’s curious, probing, rational, creative, demanding, self-aware, and humble. He leads with heart and soul, and is someone I learn from daily. My trust in him as our CEO is bone deep.”

A strong statement by any measure.

And while the Dorsey departure and Agrawal announcement cannot be blamed for Twitter shares losing all of the gains of the past year – it’s a tough start to a very high-profile job.

Acquisition opportunity?

Saxo Market’s head of equity strategy, Peter Garnry, has another take, however.

He believes Dorsey resigning as CEO and leaving the board by late 2022 “clears the way for an acquisition of the company should the right buyer with the right price come by”.

“Twitter could be an interesting bolt-on acquisition for a traditional media company that wants to enter the social media industry,” he wrote in an article.

“Investors were initially trading the shares higher on the news of Dorsey stepping down, but the shares ended lower for the session now down 43% from the peak in late February. Given the expectations from earlier this year it is clear that the company has not performed as expected and the new CEO Agrawal will have to quickly earn the trust of investors,” Garnry added.