While the pandemic raged last year, Tesla had a stalwart year. The company delivered 499,550 vehicles and estimated profit per vehicle finally became positive in Q1 at around the $3,000 mark. Tesla’s stock price climbed 743% and its automotive segment – which accounted for 94% of the company’s total revenues – posted a gross profit of $6.6bn (up 70.5% from the prior year).

In this article, Leverage Shares’ researcher Sandeep Rao looks into why – with Q3 reports just out – investors are shorting Elon Musk’s baby?

The Cash Problem

Between 2015 and 2020, Tesla’s debt grew from around $3bn to $10.5bn. Of this, $2.4bn in bonds mature between 2021 and 2023 and a credit agreement of $1.8bn matures between 2020 and 2023, totalling up to $4.2bn in debt payments for this period. Tesla’s liquidity remains a problem – with over $700m in interest expense reported for 2020, up 9% from the previous year. The Q3 update doesn’t announce any impending stock sales but also raises no “flags” on the debt front.

In addition, Tesla’s contractual obligations – mandatory purchase obligations of raw materials, components and services from suppliers and third parties – have been reported to be more than $18bn from 2020 till 2025.

To combat the issue of interest expenses, Tesla chief executive Elon Musk announced last year that the company would raise $5bn to retire debt and build up its cash reserves. This was accomplished by a $5bn stock sale in a single day. But on the matter of contractual obligations, it will likely enter a prolonged series of skirmishes with its suppliers if it attempts to address this.

The Plant Problem

Near the end of 2020, Tesla also announced plans to move production from California to Texas. For the Model 3 production line in California, Tesla spent almost $4bn for a production capacity of 250,000 Model 3s a year.

When Tesla built the Model 3 factory and production line at Giga Shanghai in China, it reportedly cost the company less than half that amount. This suggests, intuitively, that CapEx in California is an expensive affair. On the other hand, leaked internal documents showcase the estimated cost of the Texas plant to be only $400m.

This leads to one of two possible concerns for the company:

- The estimated cost might be a little optimistic, which could snowball into additional expenses in the future.

- The production capacity in Texas might be smaller, more focused or directed at other Musk-owned businesses (such as SpaceX).

On October 12, the company announced that – despite moving its HQ to Austin, Texas – it will keep expanding activities in California, including boosting output for its California plant and its Nevada battery plant by 50%. As deduced earlier, capex in California is an expensive affair and this expansion could come with significant costs in upcoming quarters.

The Europe Problem

Over in Europe, Tesla’s Giga Berlin plant – constructed at an estimated cost of €4bn – is expected to begin production by the end of this year. Europe has been an especially receptive market for battery electric vehicles (BEVs) on account of subsidies available in virtually every European country. Tesla had been a leading brand with a strong proven stable of popular models. This year, however, it has been a little different with automakers like the Renault-Nissan Alliance, Volkswagen and Ford carving out reputations in the space.

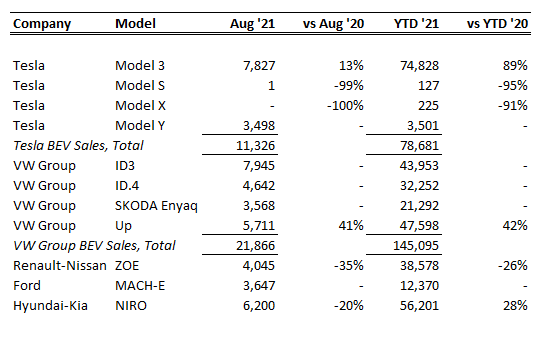

As at the end of August, it was estimated Tesla’s high-end Model S and Model X have lost flavour in Europe. This was confirmed by the company in its Q3 update where it stated that “the Model S and Model X mix reduced YoY in favour of lower ASP (average selling price) vehicles”. The company’s Model Y has been estimated to be gaining ground since its introduction to the continent in the middle of Q3 2021.

However, VW Group’s total sales volumes of its brand-new BEV models have swamped that of Tesla this year. Tesla faces ferocious competition from Hyundai as well.

The Bitcoin Problem

Perhaps to stave off these points of financial uncertainty, Tesla invested $1.5bn into Bitcoin (BTC) sometime in January 2021. Daniel Ives – an analyst at Wedbush Securities – reported the company earned more from the cryptocurrency’s appreciation by February this year (estimated at a whopping $1bn in profit) than from sales of cars through all of 2020.

The company recorded a relatively minor loss of $51m to its holdings in this quarter. As long as the company holds BTC (or, indeed, any cryptocurrency), the inherent volatility of cryptocurrencies is a problem for stock performance.

To short or not to short?

The company’s record-setting deliveries this quarter is a positive factor but the lowering volumes of higher-end vehicle sales should be a “flag”: pricier vehicles contribute a little more to the bottom line. The higher operating margin, on the other hand, is an indicator that the company’s profit-making efficiency is improving. Pushing the projection of the production of the Cybertruck, Semi and Roadster models to 2023, as reported in the Q3 release, likely implies that this operating efficiency will be translated to greater profits when the sales of these models do get off the ground.

While any suggestion of a short interest in his company’s stock invokes Musk’s ire on social media – where his meme game is strong – investor concerns in his company’s profitability are by no means unfounded, given the challenges it faces. Shorting is also a key component of price discovery for modern markets.

On the other hand, investor confidence in the company’s future does appear to be holding up. Leverage Shares had recorded a 245% increase in AUM in its Tesla-specific leveraged and tracker products in the YTD until before the Q3 update. After the announcement, this increased to 284% relative to the start of the year while AUM in its inverse/leveraged inverse instruments relaxed to a net 79% increase in AUM from start of year.

The numbers seem to suggest the company’s stock is likely to be a long-term performer – as do most analysts covering the company. However, the aforementioned issues might rear their heads on occasion to create a road bump in this company’s journey and a potential reason for investors to short.

This article was written for Expert Investor by Sandeep Rao, a researcher at Leverage Shares, which offers inverse and leveraged exchange traded products.