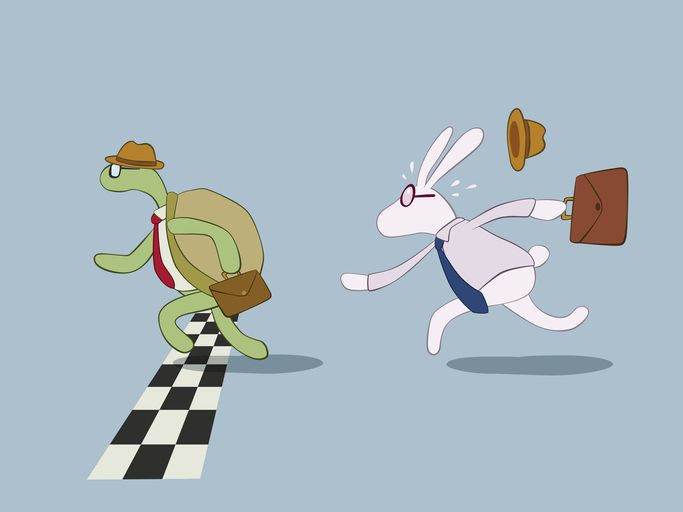

Europe’s vaccination drive was left in the dust by the US, but a recent rally has seen it surpass American efforts – which could see European stocks outperform their US counterparts.

As reported on CNBC, multiple banks and investment houses are predicting that the recovery from the pandemic is likely to be stronger in Europe than in the US. The piece quoted analysis from Goldman Sachs, Morgan Stanley, Barclays, UBS, BNP Paribas, and Saxo Bank.

The reasons given for a stronger Europe, as compared to the US, were the fiscal stimulus undertaken by the EU and a vaccination drive that picked up steam quickly after a sluggish start.

This has led, according to Goldman Sachs research, to strong flows into mutual funds and US and Asian investors becoming net buyers of European shares.

CNBC wrote: “The pan-European Stoxx 600 index is up more than 14% year-to date. In a research note in April, the Wall Street bank projected European stocks would climb 10% over the next 12 months. The index is up around 3.7% since the publication of the note.”

Competitive, yes. But better?

There are several reasons for Europe’s recovery, according to BNP Paribas. In a recent outlook report, its analysts wrote: “Signs of inflationary pressures, accommodative fiscal and monetary policy and relatively attractive valuations support a continuation of the recovery-driven rotation to the Value factor,” the bank’s analysts said in its third-quarter outlook report.”

Others in the report were more critical. CNBC reported that the month previously, Peter Toogood, chief investment officer at Embark Group, had said that European stocks may be competitive with their American counterparts, but would not be able to surpass them.

Toogood suggested that this would be because the recovery on the continent was “[…] too slow off the mark, and that the unlikelihood of covid disappearing through winter meant gains would remain stunted”.

Other outlets have been reporting a surge in European stock purchases. At the end of May, Market Watch reported that the ETFs JPMorgan BetaBuilders Europe, the iShares MSCI Eurozone, and the Vanguard FTSE Europe were three of the top eight stock funds purchased by US-based investors.

The piece reported Matthew Bartolinii, head of SPDR Amercias Research at State Street Global Advisors, saying that $4bn in flows had gone into European ETFs, and that this had been the best month for the region since March 2015.

All this has been buttressed by recent reporting in Barron’s. In June, it said: “The S&P 500 is near an all-time-high it achieved a month ago, although it has been in a tight range since then, caused by the realisation that inflation is hotter than expected. That has stoked concerns that the Federal Reserve could soon tighten credit, which would lift bond yields, and may, by some estimates, trigger a correction of more than 15%.”

It added: “All that underscores the opportunity in European stocks, which recently began to outperform the US. The Stoxx Europe 600, up considerably Tuesday on news of growth in European Union purchasing managers index readings, has risen 2.3% in the past month, better than the S&P 500’s 0.1% gain in that time.

“Vaccinations and reopenings in Europe have increased. German consumer confidence, an indicator of how much consumers will soon spend, has risen since early May, according to Bloomberg data. French business confidence shot up in May, recently rising above its pre-pandemic level.”