The European Central Bank followed in the well-trodden footsteps of its peers and opted to hike its three key interest rates at a meeting on 2 February.

Whereas the US, which started its rate hiking cycle first, went for a 25bps uplift in its Federal Funds range; the governing council of the ECB and the Bank of England both went for 50bps.

As such, from 8 February, the interest rate on Europe’s main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will be increased to 3%, 3.25% and 2.5%, respectively.

Europe’s central bank was last out of the gate, at least with regards to the trio names above, when it comes to starting down the thorny path of raising interest rates from long-standing historic lows.

The US range now sits at 4.5% to 4.75%, while the BoE base rate is 4%.

The question on everyone’s lips was what the move, which was well telegraphed, indicates for future changes.

Steve Ryder, senior portfolio manager at Aviva Investors, said: “Today, the ECB signalled a strong commitment to hike by 50bps again at the March meeting, but from there adopt a more data dependent approach.

“After the Fed and BoE both hinted at being close to the peak in their cycles, today’s meeting suggests the ECB are comfortable that they are also close to the end of their monetary tightening. We believe this peak tightening backdrop will continue to reduce volatility in government bonds over the coming months and make for an attractive income opportunity.”

BRI Wealth Management portfolio manager Tom Hopkins pointed to data released on Wednesday showing “that underlying inflationary pressures in the region remain uncomfortably high”.

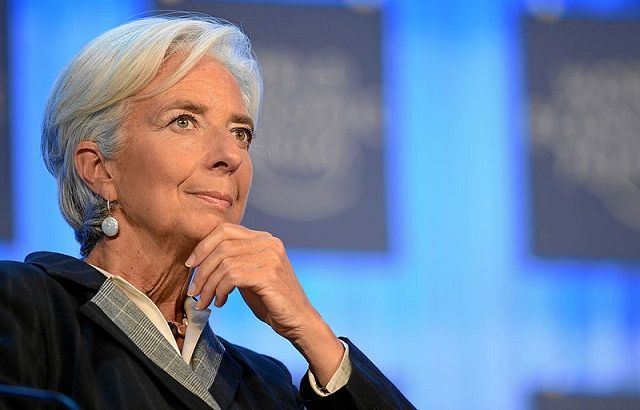

“Core inflation which is considered the best measure of the stickiness of price pressures remained unchanged at an all-time high of 5.2% in the year to January, a concern for policymakers. Investors will be looking ahead to [ECB president] Christine Lagarde’s speech, trying to gauge the ECB’s rhetoric about future additional tightening.”

He added: “It’s a tricky balancing act for the ECB. Inflation needs to come down to relieve the cost-of-living pressures, but the economy is slowing, and businesses are being impacted by struggling to find affordable credit. Consumer confidence is at rock bottom as incentives for households to save are now much stronger coupled with worries about being laid off, means households are stockpiling funds for a rainy day.”

In light of it being “much further behind in the hiking cycle”, Quilter Cheviot’s Richard Carter believes the ECB “still has some way to go before it can think about pausing or pivoting”.

“So much so, it has already committed to a 50bps rise in rates at its next meeting in March, before it begins to reassess,” the head of fixed income research added.

“European economies are holding up okay in the face of inflation and rising rates, but the spectre of recession remains ever present in today’s environment. Given there is a chance the ECB may still be raising rates while others can pause and take a breath is not an ideal scenario for the region.

“With conflict in Ukraine persisting, the recent fall in energy prices has not been enough to help bring down core inflation, and this is what the ECB will be watching closely as it tries to get back on to a path of normal monetary policy. It is more exposed to the ramifications of Russia’s invasion of Ukraine, and for as long as that continues to bring economic issues, Europe will suffer more heavily as a result.”

Edward Park, CIO at Brooks Macdonald, added: “Before today’s meeting, European bond markets were volatile as investors tried to reconcile better data, falling inflation, and lower energy prices with a hawkish central bank. The market had priced in a 50bp hike and a good chance of another in March, but the ECB’s terminal rate is expected to be only 3.25%, much lower than the BoE and the Fed.

“The ECB is expected to maintain its hawkish narrative, as they are further from restrictive territory than the US and UK, who have already raised interest rates.”