Basic biology means energy, water and food remain the most important economic goods – and so significant themes for informed investors

The energy-water-food ‘nexus’ is now widely recognised as a critical element in efforts to combat climate change. Crucially, the number of potential investment themes emerging from it is practically without limit, as are the possible opportunities over the medium to long term.

Human beings run on energy, but we can only get energy from food, while water is also critical for human functioning. As a result, the oldest and most important uses of energy are to collect, store and distribute water and to find, cultivate and deliver food. The mix of energy sources is always changing, but each era of human history is associated with a particular energy source – the current one with oil.

The economics and logistics of water and food are, however, changing. Some of the changes arise from the need to use energy more efficiently in producing food and making water available. Others are due to water scarcity, while still others reflect the need to feed our world’s population. This – along with wider pressures to reduce our dependency – means we are nearing the end of the ‘Oil Age’. We do not know what to call the next age because the current energy transition is exploring many possible ways of producing energy – but we do know that changes on this scale offer a myriad of opportunities to investors.

Smart water delivery

Most of earth’s water is undrinkable. The infrastructure for collecting, storing and delivering water needs to be rebuilt or built from scratch almost everywhere in the world, an undertaking that will involve trillions of dollars in infrastructure investments over time.

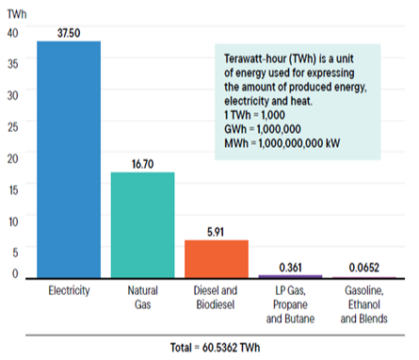

One area, agriculture, accounts for 70% of the world’s water use, and irrigation is key to making much of the world’s land arable. Yet irrigation is also energy intensive – in the United States alone nearly 20% of US energy consumption in 2018 was used to deliver irrigation water, broken down in Chart 1 below, so there is a clear opportunity for irrigation to be made more efficient and effective.

Chart 1: Estimated US energy consumption for irrigation pumping (2018)

Source: Sowby R, and E Dicataldo. 2022. The Energy Footprint of the US irrigation: A First Estimate from Open Data. Energy Nexus (vol 6), 16 June 2022

Flood irrigation can be incredibly wasteful but, because it is so cheap and easy, it will continue to be used where water is abundant, and techniques for improving its efficiency represent an opportunity for investors. Most of the water from flood irrigation never reaches the plant roots and simply flows back to its source. It often involves energy-intensive pumping of water over long distances and potentially uphill, but it can be made more efficient by, for example, levelling the fields and capturing and reusing the run-off water.

‘Centre-pivot’ irrigation (a form of spray irrigation) also wastes water due to evaporation but again it is cheap and easy and thus destined to survive. One improvement to it could be drip irrigation, which is just sprinkler irrigation at low-water pressure resulting in more water reaching the plant roots and less evaporation or run-offs.

The most exciting and potentially most profitable changes in irrigation technology involve artificial intelligence, analytics and connected sensors according to a 2020 McKinsey report, Agriculture’s Connected Future: How Technology Can Yield New Growth, which suggested it could add $500bn (€456bn) to global gross domestic product by 2030. To get started, fast internet connections would have to be made available in rural locations, including in developing countries, involving a large investment in satellites and on-the-ground devices.

‘Green’ fertiliser production

We expect changes in the way that fertiliser for crops are produced. These changes will occur for natural economic reasons – such as rising energy costs – and because of regulations and incentives. If investors can get ahead of these changes, they can potentially earn exceptional returns.

Crops are going to continue to need fertiliser and the process is under way to find a replacement for the dominant Haber-Bosch method in order to become more energy-efficient, water-efficient and environmentally sound – though, so far, success at replacing Haber-Bosch with other processes has been modest. Even if we cannot find a substitute, however, moving Haber-Bosch to using renewable energy would be a large investment opportunity, although it would not solve the direct-emissions problem that process creates.

Increased calorie consumption

The recent rise in energy prices, alongside Covid-related supply and logistical challenges, has also harmed food production and affordability. While we expect problems to resolve, the fact that issues became as serious as they did – and persist years later – shows our vulnerability to natural occurrences and reminds us that progress is never guaranteed.

Economic growth and the adoption of 21st-century water and agritech and farming practices, including genetically modified organism (GMO) crops and livestock, will enable per-capita caloric intake to grow in the next 20 years. The need to increase the absolute amount of food grown to address food insecurity will also present many opportunities to investors – as will the tendency of people to consume higher-quality food as per-capita gross domestic product rises.

GMO foods not only increase food yields and enable crops and livestock to be grown in a broader range of environments; they are also still an investment opportunity – as we are not finished modifying the genomes of the organisms we consume.

To conclude, energy, water and food are still the most important economic goods because of our basic biology. The amount of investment related to them will remain large with global economic growth, efforts to combat climate change intensifying this tendency.

This expected investment in the real economy will correspond to high returns in the capital markets that support real investment. By carefully analysing the thematic opportunities we have identified and purchasing stocks and other securities that will benefit from these trends, that substantial alpha can be generated over the medium to long term.

Stephen Dover is chief market strategist at Franklin Templeton and head of the Franklin Templeton Institute