While ESG has recently become a staple in most asset managers’ day jobs, for those specialising in emerging markets, many of these considerations have been a standard component of the investment process for quite some time, writes BlueBay Asset Management’s Anthony Kettle.

Ahead of the ESG curve?

Emerging market issuers typically undergo more scrutiny from investors than their developed market peers, simply as a consequence of the environment in which they operate. Historically, certain ESG factors, such as governance (G) as well as the social and political backdrop (S) have played a critical role in the fundamental and risk analysis of emerging market credits, both sovereign and corporate.

Indeed, even as this market has matured, it would be challenging to invest successfully in this space without considering these particular inputs when evaluating the downside and upside potential for a given investment.

As a result, for emerging market investors, applying this analysis within a more explicit ESG framework has been a natural extension. The focus on environmental factors is newer to the equation, as it is across most asset classes. Here as well, those emerging market investors who have established strong dialogue with issuers over the years have been successfully extending their ongoing engagement to include environmental and other ESG related topics.

Pivotal for advancing the ESG agenda globally

The emerging market universe represents roughly 60% of the world economy and 75% of global growth – almost double that of 20 years ago. It also accounts for more than $2trn – or about a quarter – of the global fixed income market.

The role of this segment of issuers will inevitably become more significant in global economic and social developments, including the ability to progress toward broader ESG objectives.

As in developed markets, governments and companies have embraced these objectives to varying degrees, but we believe that investors can play an instrumental role in the effort to create more alignment across all stakeholders within the ESG investment landscape.

ESG credentials have been improving

Although it can be counterintuitive, our experience shows that despite often starting at a lower base level in terms of ESG profile, emerging market issuers tend to be more receptive to engagement on ESG topics than one would expect.

This can be partially attributed to the fact that many do not have as many alternative sources of financing and that creditors therefore have more leverage. However, we have also found that in many instances engagement plays an important positive role in heightening awareness amongst emerging market issuers when it comes to the value of transparency and open dialogue as well as market practice and developments in this arena.

It is also fair to say that many emerging market corporates have made significant strides in strengthening their ESG credentials. Certain sectors of course naturally lend themselves to stronger ESG credentials and the renewables sector across both Asia and Latin America has been a key growth area.

Other sectors, particularly those that are resource intensive, have more challenging ESG profiles but emerging market corporates have mostly been receptive to trying to improve their ESG ratings. For example, we have recently seen a pickup in the issuance of sustainability linked bonds, particularly from the industrial sector which are at the higher risk end of the ESG spectrum. The telecoms sector is another where we have positive example of ESG engagement.

Emerging market sovereigns are also increasingly appreciating the impact ESG can have on investors’ views and therefore their borrowing costs, further opening up opportunities for dialogue on these issues.

For instance, through our work as co-chair for the Investor Policy Dialogue on Deforestation, we have held several talks with Brazilian government officials to address our concerns around the illegal deforestation of the Amazon. We recognise that Brazil’s overall ESG performance is generally good, with strong institutional governance and a very green energy matrix, for example.

We nevertheless identified deforestation as a threat to water and food security and to export market access among other potential consequences, and therefore wanted to ensure that the Brazilian authorities understood that we see it as a risk for our portfolios. We are pleased to report extensive and ongoing engagement, which has contributed to moving the topic up the government’s agenda, although we remain critical of the Bolsonaro administration’s progress.

Rising focus on ESG has also created opportunity

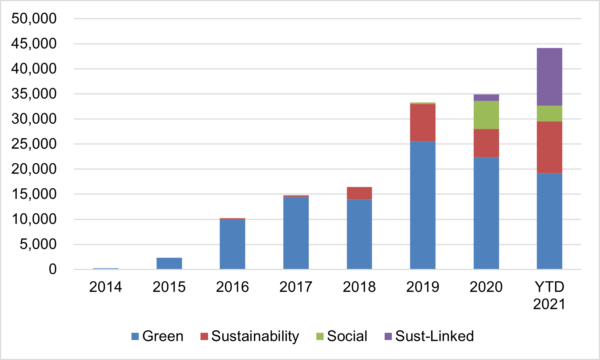

Positive developments on the ESG front have not only contributed to improving the credit profile of issuers, but they have also created more opportunities in the market. Over the last few years, we have seen a wave of ESG type bond issuance, ranging from green to sustainability or sustainability-linked to social bonds. This trend has been gaining traction even beyond the more traditional sectors (such as renewable energy), with issuance out of cement, petrochemicals and auto part companies.

This not only shows that the relevance of the ESG discussion is growing, but also that it provides investors with a broader opportunity set of sectors to invest in, within the ESG-friendly space.

Emerging market ESG issuance, USD(m)

The force of this trend shows how quickly the market can seize new opportunities, and the recognition of the value of ESG as key selling point in raising capital is a positive development. However, it is also true that there are also some concerns, many of them valid, regarding greenwashing.

In our experience, whether it is an ESG labeled bond or the ESG analysis of a manager, the importance of looking beyond labels can’t be emphasised enough. The market currently hasn’t adopted a standard set of criteria for establishing or measuring ESG metrics. In emerging markets, we have the added complexity that ESG ratings from agencies are often inconsistent or backward looking, and that many of the companies and countries are not well understood by most of the market. This makes it even more important to rely on specialists who have a deep understanding of the nuances around each name which can be applied in the context of a credible ESG framework.

Looking ahead

There is often a misconception that ESG and emerging markets don’t mix. While the lack of transparency from some emerging market companies is certainly challenging, it is also fair to say that certain ESG evaluation metrics a highly correlated with income levels and therefore can disproportionately impact poorer countries, which are likely to be those most in need of capital flows.

Equally, the rather static approach to ESG ratings from agencies has perpetuated this perception even further, as they don’t distinguish between the “snapshot” level of ESG risk and the materiality of the current direction of travel among emerging market issuers.

Over the last few years we have seen the level of commitment to ESG development strengthen meaningfully across issuers and investors within emerging market.

While there is still work to do, we believe strongly that emerging markets will play a key role in the evolution of the global ESG landscape. This should create a multitude of opportunities to build momentum behind the process and also invest in the resulting positive stories.

This article was written for Expert Investor by Anthony Kettle, senior portfolio manager at BlueBay Asset Management.