German asset manager DWS is set to deliver a death blow to its Russia ETF.

It has been reported widely that the ETF, which it suspended earlier this year, is to be discontinued after MSCI said it would halt the underlying index in March.

The final index calculation for the Xtrackers MSCI Russia Capped SWAP Ucits ETF will take place on 16 December, even though it is currently suspended. The ETF will be delisted from the London Stock Exchange, Deutsche Boerse, and Borsa Italiana soon after. Reports elsewhere state that the ETF’s total assets under management as of March this year stood at £82m. DWS has also reportedly said that redemptions would be ‘zero or close to zero’ due to the fund’s valuation.

DWS said: “The index administrator has recently advised that the reference index will be discontinued as of 1 March 2023.”

It added: “In addition, the current derivatives invested in by the sub-fund are due to expire and the sub-fund will not be able to renew these derivatives due to applicable sanctions legislation.”

ETF Stream has traced comparisons between DWS’s actions and those of firms such as Invesco and Blackrock. The former, it wrote, shut its rival products on 21 June, a day after Blackrock terminated its Russia-exposed ETFs. Blackrock, it wrote, is keeping shares of the products on its fund register while it converts their GDRs into underlying shares.

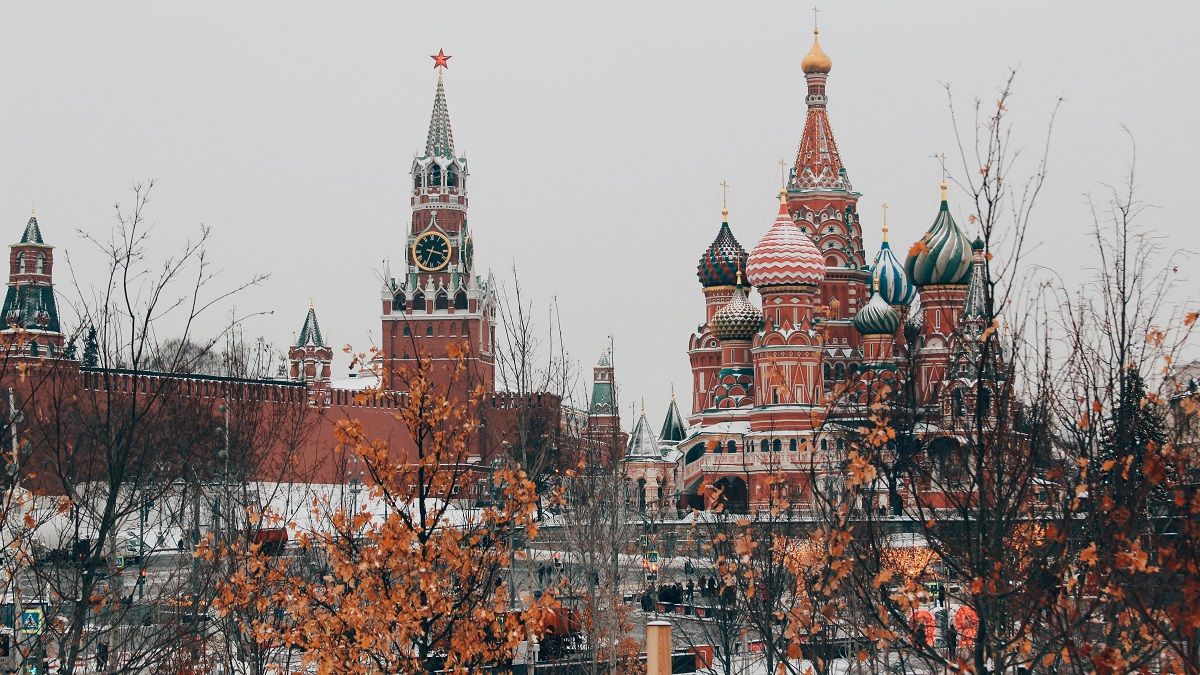

Earlier this year, Expert Investor wrote about how Russia’s invasion of Ukraine had been disastrous for fund performance.

Back then, the BMO Multi-Manager Fundwatch Q1 2022 report found that its consistency ratio for top quartile returns over three years had fallen, by the end of Q1 2022, to 0.45% – a marked drop from the 2.1% registered in the preceding quarter.

Writing in the report, Kelly Prior, investment manager at the firm, said: “The BMO MM Consistency Ratio for top quartile returns over three years (to the end of Q1 2022) has been significantly impacted by the invasion of Ukraine by Russia, and its huge geopolitical impact on resources, different geographies and global interest rates and currency markets. The ratio has tumbled to an all-time low of 0.45% (2.1% last time) with just five of the 1,115 funds achieving this feat. This ratio’s typical range over the time we have been running this research was circa. 2-4%.”

Prior added: “Only five funds from five different sectors manage the consistency of top quartile returns – the sectors are the IA Europe ex-UK, the IA UK All Companies, IA £ Corporate Bond, IA £ Strategic Bond and IA Japan.”