BlackRock takes lead in €1.1bn capital raise by Sweden’s Northvolt

Latest funding an extension of the $1.1bn convertible issued in July 2022

Latest funding an extension of the $1.1bn convertible issued in July 2022

Fund will have a minimum of 80% of its assets in sustainable investments

Strategies made available in Finland, Norway, and Sweden

The Spanish government has nominated the country’s deputy prime minister Nadia Calviño to run the European Investment Bank (EIB). The news comes six weeks after Margrethe Vestager, the European Union’s digital and competition chief, entered the race to succeed Werner Hoyer, who is due to step down at the end of the year after serving…

Nomura Asset Management (NAM) has launched a corporate hybrid bond fund open to investors across Europe. The Nomura Funds Ireland – Corporate Hybrid Bond Fund aims to provide investors with exposure to high quality issuers with yields comparable to those of high yield bonds. The strategy will be managed by NAM head of corporate hybrid…

Investors focused on what course the ECB will take after its September meeting

Association for Financial Markets in Europe has released its latest Equity Primary Markets and Trading Report

The European Investment Bank (EIB) has signed a €315m loan agreement with Spanish telecommunications firm Cellnex to support 5G rollouts in France, Italy, Poland, Portugal and Spain. According to Cellnex, the loan will mobilise total investment of €631m to improve and expand the coverage and capacity of very high bandwidth mobile network infrastructure in these…

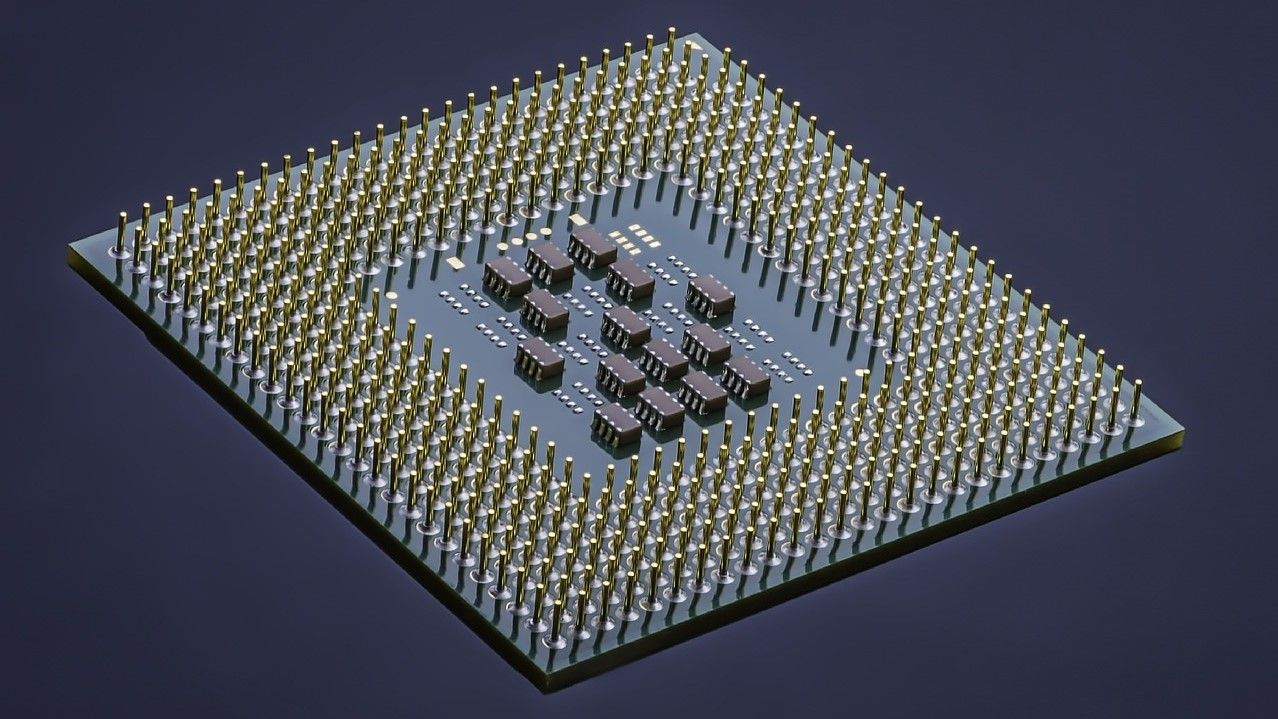

The ‘Chips Act’, aimed at boosting Europe’s semiconductor industry, has received the green light from The European Council. The Act, about which Expert Investor has written extensively over the last year, will seek to help develop a European industrial base in the field of semiconductors, attract investment, promote research and innovation, and prepare the continent…

The firm said the fund will provide access to direct private market investments

Focused on growing a ‘Technology Campus’

The Destatis agency said German CPI reached 6.4 per cent in June