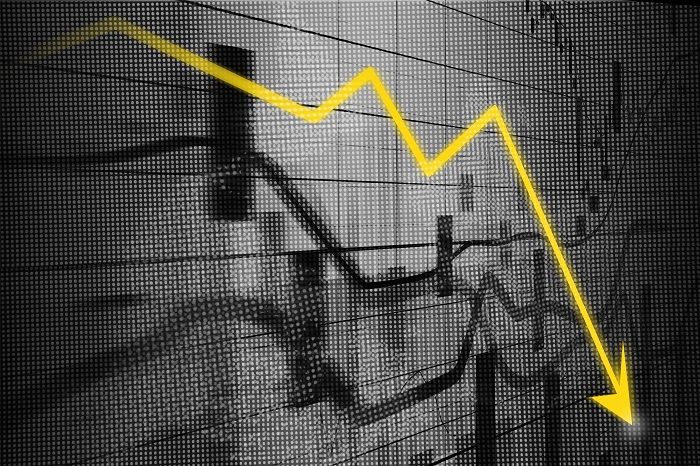

Active bond fund flows take hit in Feb

Active bonds suffered €7bn in outflows along with active commodities and convertibles, hitting Europe’s asset management industry for the month of February.

Active bonds suffered €7bn in outflows along with active commodities and convertibles, hitting Europe’s asset management industry for the month of February.

From fees to tracking error to “two-way flows”, fund buyers and unsuspecting investors can be caught off guard by some of the inside language used by the ETF industry, warns 7IM senior investment manager Peter Sleep.

European investors in a number of iShares ETFs remain exposed to guns as Blackrock responds to the recent school shooting tragedy in Florida in its US range through the launch of firearm-free products.

Sometimes the details reveal the bigger picture. On research trips, Wellington’s portfolio managers take a deep-dive approach — including, on one manager’s visit to China, finding out what apps young people have on their phones. The popularity of digital forums like Little Red Book, where consumers post product reviews, shows how buying habits are changing.…

BlackRock has launched a new ETF to help investors diversify their global equity allocation.

The inclusion of Chinese bonds in the Bloomberg Barclays Aggregate Index is an incremental step in China opening up its economy that has been welcomed by investors, but their introduction to popular emerging market indices could be more disruptive.

Financial services firms need to prepare to step into the world of fintech or they will be under threat by other industries moving into the space, according to ABN Amro Investment Solutions.

European fund selectors expressed a preference towards growth emerging market funds over value during the last six months. However, Europe’s top performing funds allocated a greater weighting towards value stocks during the period.

Latin American equity funds have posted solid returns over the last three years on the back of re-bounding commodity prices and Brazil’s return to growth. But elections in three of the region’s largest economies this year could have a significant impact on their prospects.

Wellington Management is a pioneer in emerging markets investing. Through a distinctive combination of expertise and collaboration, we gain deep insight into how companies and countries are evolving worldwide. Find out how that helps us reveal new opportunities for investors. Professional investors only. Capital at risk.

Netherlands-based asset manager NN Investment Partners has launched a short duration emerging markets debt fund.

Not all FTSE All-Share trackers are priced equally and the costliest passive exposure comes from the Virgin UK Tracker with a whopping 1% charge. Click through the gallery below for the five cheapest funds on offer and help investors get more for less.