Assessing impact of Mercosur and Vietnam EU trade deals

As eurozone growth stalls, analysts weigh up how two major EU trade deals will translate into investor returns

As eurozone growth stalls, analysts weigh up how two major EU trade deals will translate into investor returns

After a bumpy start, investors are getting to grips with risk opportunities under Amlo, says Barings’ Omotunde Lawal

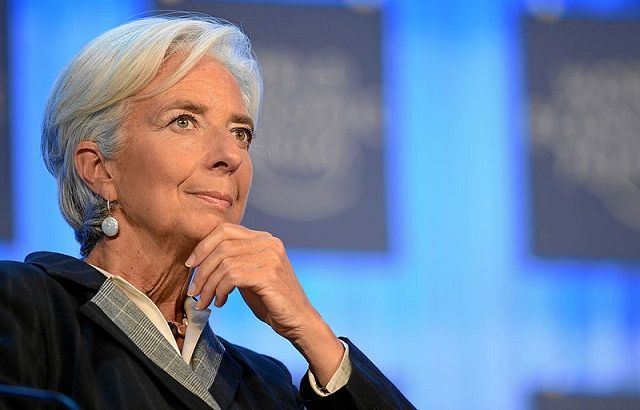

French lawyer expected to continue predecessor’s aggressive monetary policy should inflation stay sluggish

Three new Ucits funds will focus on opportunities created by innovations in AI, healthcare and clean water

Beleaguered fund manager’s explanation as to why illiquid positions swelled defies economic logic, say analysts

Over three quarters of fund selectors polled in Luxembourg said they were avoiding illiquid assets at present time

Investment case for BTPs remains compelling despite concerns over country’s populist government, says Allianz

It would be easy to lose faith in absolute return after it suffered big outflows last year, but value can still be found

Quarterly Outlook – Global Equities

Quarterly Outlook – Japan Equities

Quarterly Outlook – Fixed Income

H2O Allegro has continuously exceeded its prospectus target volatility range, according to research group