The DAX in Germany has recovered somewhat after plunging at the beginning of the week.

After reaching 15,194.49 on Tuesday, the index plummeted to 14,480.85 the following day before rising, falteringly, to 15,156.94 at the time of writing. The latest action on the DAX follows an erratic downcurve since the middle of August when it reached its last high of 15,977.44.

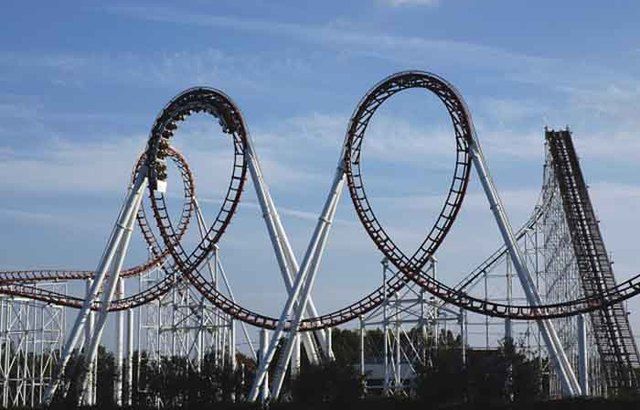

People were quick to point out the fluctuations. Over at Handelsblatt, Jurgen Roder wrote, “The German stock market is riding a roller coaster.”

Roder was also pessimistic about the immediate future. “Initially, the Dax slipped by more than 370 points to the daily low of 14,818 points,” he wrote, “but then rose again above the 15,000 point mark. After that, significant sales set in again, which caused the stock market barometer to slip to 14,924 positions. At the close of trading, the Frankfurt benchmark was trading at 14,973 points, down 1.5%. As a result, it could go down further in the next few days.”

At Tagesschau, the picture was more mixed. Writing today, the broadcaster said: “The technical picture for the German leading index has now brightened significantly. With today’s price jump, the DAX has not only regained its recent lows, but above all the 200-day line (currently at 15,029 points).”

“Meanwhile,” it went on, “negative signals for the DAX are coming from the economic front. In August, the German economy reduced its production more sharply than at any time since April 2020. Industry, construction and energy suppliers together produced 4.0 percent less than in the previous month.”

Other publications have been negative. Published today, German news magazine Focus questioned whether a crash was imminent. However, two of its interviewees said a crash was unlikely, pointing instead to a small correction.

Said Stefan Eberhardt, managing director of Eberhardt & Cie, “We expect a short-term strong, but not permanent correction and expect prices to rise again in the near future.

“The current uncertainty is based on supply bottlenecks, such as semiconductors, volatile commodity prices and increasingly fragile world trade.”