VBDO benchmark finds 34% lacked ‘proper ESG integration in tax matters’, writes Natasha Turner

European companies are becoming ever-more responsible taxpayers, but a third still lack proper ESG integration on tax matters, this year’s Tax Transparency Benchmark has found.

The benchmark, which has been published by the Association of Investors for Sustainable Development (VBDO) and PwC, this year has assessed 116 participating companies (51 from the Netherlands and 65 from the EU) on European tax transparency against a set of good tax governance principles. It has also updated its methodology this year to include ESG expectations.

Dutch dominance

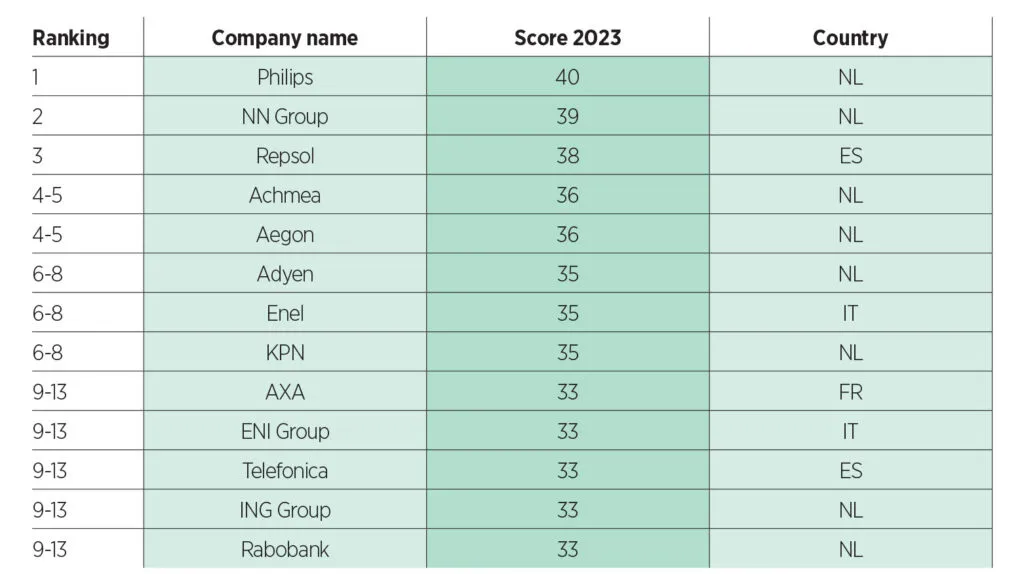

It found Dutch electronics company Philips took the top spot, with NN Group dropping one point from last year. Spain’s Repsol ranked third with 38 points.

Moreover, 96% of Dutch companies and 85% of the EU companies in scope disclosed a tax strategy that sets out the company’s views on tax transparency, but 34% lacked “proper ESG integration in tax matters”, the report said.

On a sector breakdown the energy and financial sectors score relatively high, and the pharmaceutical industry in particular scored less well.

“To go beyond ‘mere compliance’ to become a responsible taxpayer, a company must align its core values, organisational culture, and morals, with that of its policies, strategies, and, especially, its way of operating,” said Angélique Laskewitz, director of VBDO.

“Understanding the correlation between one’s working culture and the way it operates commercially is a vital part of driving sustainability and acknowledging the organisation’s role in society.”

Combined top 13 EU+NL

Source: Transparency Benchmark 2023

Part of the shift towards more responsible tax practice has been caused by regulatory changes, the report noted. For example, the recent VNO-NCW Tax Governance Code, updates to the Corporate Sustainability Reporting Directive (CSRD), and the implications of the SFDR and EU taxonomy.

“With the introduction of the CSRD and the tax reporting requirements this may entail, there is an expectation that companies will make further progress in this area in the coming years,” noted Brenda Mooijekind, vice president of PwC’s tax advisory practice.

Responsible tax policies

But internally companies also appear to be recognising the importance of responsible tax policies. The report found nine out of 10 companies have their own tax policy or strategy, although in almost half of the companies, these are still approved by management.

“Tax clearly is a strange duck in the world of sustainability,” remarked Dave Reubzaet, director tax and sustainability at Deloitte and former tax lead at the Global Reporting Initiative.

“It is often not included in sustainable finance frameworks or corporate sustainability strategies, but when you talk about the fundamental role of tax for sustainable societies, many stakeholders see it as a no-brainer to include tax in (soft) regulations and sustainability strategies. This is especially true when one considers the potential harmful impact that avoiding tax can make, as this undermines companies’ contributions to other sustainability goals, for example the prevention of biodiversity loss or climate change mitigation.”