Asian equities have been underrepresented in most global portfolios relative to the size of the opportunities and depth of its market, writes Fullerton Fund Management’s Saurabh Chugh (pictured).

This space is often viewed as a niche area that presents more trouble than it’s worth. Consequently, many investors tend to have exposure to Asia through index funds or as part of broader global portfolios.

Asia is a complex and dynamic region comprising over ten different countries, each with its own currency, language, regulatory regime, and cultural nuances. However, investors with deep local insights can reap rich dividends as it is also one of the most “alpha” rich markets. Moreover, Asian markets still exhibit a significant degree of information asymmetry and thereby offers opportunity for diligent investors in search of the elusive “multi-bagger”.

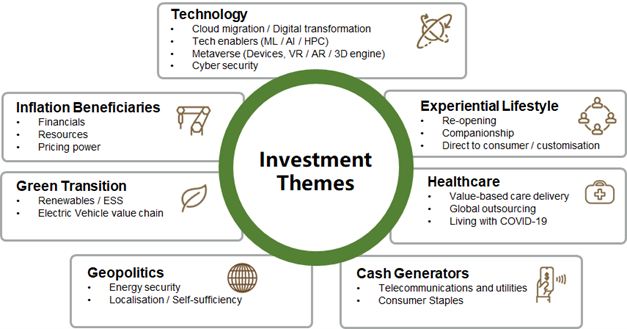

Long-term structural themes in Asia – as viewed by Fullerton

Our confidence in Asian equities stems from a confluence of factors, which we believe lays the foundation for strong profit growth over an extended period. These include a favourable macro-economic regime, investments in R&D, rising discretionary spending, and the coming of age of Asian innovation.

Asia’s macro-economic fundamentals are in a much better shape emerging from Covid than in many other regions. Balance sheets remain healthy across households, corporates and governments. Both monetary and fiscal policies across Asia have been conservative through the pandemic. Thus, policy makers have retained ammunition to support growth when required.

While the macro-economic backdrop is supportive, the real growth driver is the emergence of global leaders in Asia across multiple industries. For example, TSMC (Taiwan Semiconductor Manufacturing Corporation) and Samsung Electronics are well known to investors globally, but Asia’s technology sector is much deeper.

The region is home to a large number of high-quality growth stocks across sub-sectors like semiconductors, electronic components as well as software and IT services. Many of these companies are direct beneficiaries of structural trends like cloud migration, the Metaverse, and digitalisation of enterprises across Asia.

The depth of Asia’s technology sector is evident from the fact that Asia ex-Japan has over 125 tech companies with a market cap greater than $5bn, second only to United States, and almost five times more than its European peers.

Asia is also a global leader in the internet/e-commerce space, and China’s e-commerce ecosystem remains the largest and most advanced globally. However, much less appreciated is the fact that countries outside China have also witnessed an increase in user penetration, and multiple companies have emerged across the region in recent years across various sectors, with many aspiring to be “super-apps”.

Examples include the likes of Naver and Kakao in Korea; SEA, Grab and Goto in Southeast Asia; and Zomato, and Nykaa in India.

While many could be facing short-term pressures emanating from enhanced regulatory scrutiny, slowing demand and valuation de-rating in the medium term, the emergence of such companies has nonetheless permanently shifted the sector composition of Asian markets towards the “new economy” sectors.

Another enabler of the digital revolution has been the modernised payments system architecture. India’s United Payments Interface (UPI) has allowed the country to leapfrog many advanced peers in terms of digital transactions. This has facilitated new business models and democratised access to financial services. Banks in the region have also sharply stepped-up spending on digital transformation and partnered with Fintechs to raise productivity and launch new products.

Energy transition is another sector where Asian companies are at the forefront of tackling climate change. As it is, a vast majority of industries required to combat climate change have been incubated and brought to scale in Asia. A significant part of the value chain for sectors like solar, Electric Vehicles (EV) and hydrogen resides in Asia and includes also global market leaders in many sub-segments. Companies like Longi Green Energy (solar) and CATL (EV batteries) are global leaders in their respective segments.

Another interesting development is the emergence of Asian consumer brands. Asian consumers, specifically China consumers, have been the driving force powering growth for many large US and European consumer brands.

Ironically, Asian companies have not benefited from the rise of the Asian consumer until now. We are seeing the emergence of local brands in each Asian market and, over time, these brands could capture some of the consumer surpluses across the region.

This includes brands across a variety of sectors, from sportswear to cosmetics as well as EV OEMs. We believe that Asia remains a “too big and too attractive to ignore” opportunity for investors. Although GDP growth over the next decade may be slower, the enduring trends discussed above will likely translate to higher earnings growth and ROE improvements, which may, in turn, lead to improved Asian equity valuations.

This article was written for Expert Investor by Saurabh Chugh, portfolio manager, Fullerton Fund Management.