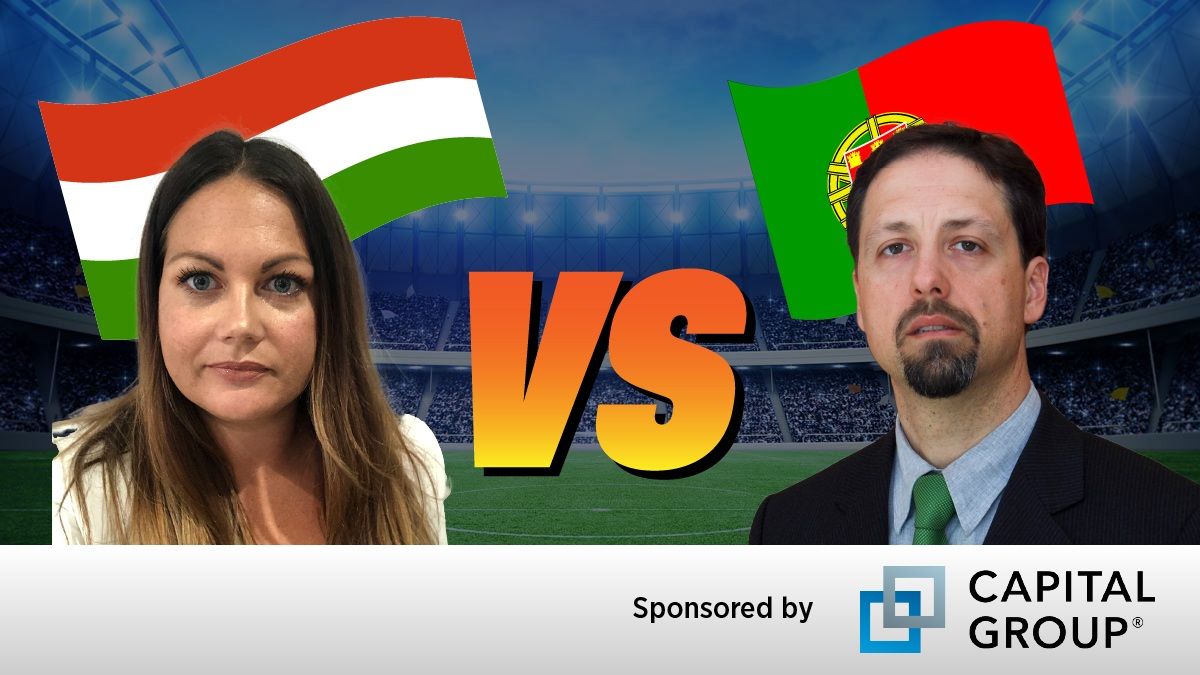

NATALIE KENWAY

GLOBAL HEAD OF ESG INSIGHT

ESG CLARITY

Score prediction: HUNGARY 1 – PORTUGAL 2

INVESTMENT INSIGHT:

Arguably, one of the most famous living Hungarians is George Soros. Born György Schwartz in Budapest in 1930, he lived through Nazi occupation and the rise of communism in his homeland before moving to London in 1947 and emigrating to the United States in 1956.

He made his fortune by setting up a hedge fund called Soros Fund Management. Soros is recognised as one of the most successful investors in the US, with his name often spoken in the same breath as Warren Buffett.

In 1992, he shorted the British pound, earning the nickname ‘the man who broke the Bank of England’. He is reported to have made $1bn in profit from the move and currently ranks 288th on the Forbes rich list.

But his early experiences in Hungary likely shaped his life-long philanthropic efforts – which is undoubtedly where his focus now lies, having stepped back from managing money in 2011. To date, he has given away more than $32bn and has a current net worth of $8.6bn.

“I occupy an exceptional position,” Soros is quoted as saying. “My success in the financial markets has given me a greater degree of independence than most other people. This allows me to take a stand on controversial issues: in fact, it obliges me to do so.”

RUI CASTRO PACHECO

DEPUTY CHIEF INVESTMENT OFFICER

BANCO BEST

Score prediction: HUNGARY 0 – PORTUGAL 3

INVESTMENT INSIGHT:

Corticeira Amorin – COR

We have, in Portugal, a company that is more than 150 years old, which combines “old tradition” with new technologies in a company that operates in many challenging business lines.

Tracing its roots back to the 19th century, Amorim has become the world’s largest cork and cork-derived company in the world, generating more than €740m in sales to more than 100 countries through a network of dozens of fully-owned subsidiaries.

With multi-million euro R&D investment per year, Amorim has applied its specialist knowledge to this centuries-old traditional culture, developing a vast portfolio of 100% sustainable products that are used by blue-chip clients in industries as diverse and demanding as wines & spirits, aerospace, automotive, construction, sports, interior and fashion design.

Amorim’s responsible approach to raw materials and sustainable production illustrates the remarkable interdependence between industry and a vital ecosystem – one of the world’s most balanced examples of social, economic and environmental development.

In 2020, Amorim reinforced its sustainability commitments, joining Act4Nature Portugal, to protect, promote and restore biodiversity; and the 50 Sustainability & Climate Leaders initiative, showing that it is possible to lead by combining sustainability, technology and innovation.

They have also €40m in green bonds allocated to investments that leverage the sustainability of the operations.

Source: Amorim website and Annual Account Report